Pumps and valves: An emerging industry

By EPR Magazine Editorial May 26, 2020 5:20 pm IST

By EPR Magazine Editorial May 26, 2020 5:20 pm IST

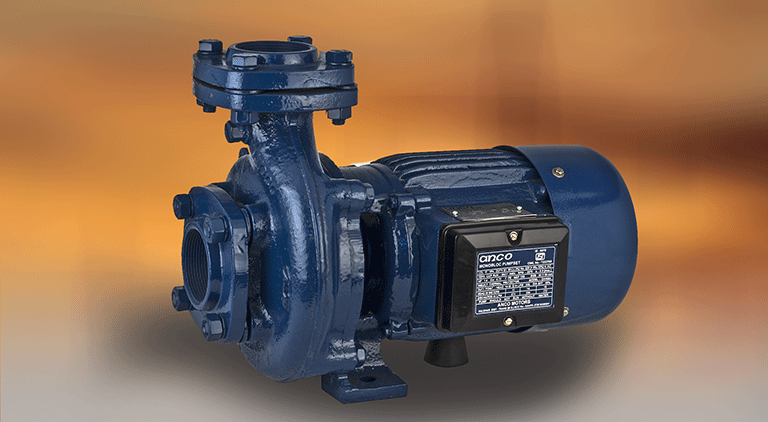

The Indian pump and valve industry contributes significantly to the country’s growth, given its role as basic equipment in almost every sphere including infrastructure and agriculture.

The Indian pump and valve market can be segregated on the basis of end use. The main sectors in which pumps and valves are used are agriculture/irrigation, building services, water, wastewater/sewage management, and industrial uses (power, oil and gas, metals and mining, etc.). Pumps are generally classified into positive displacement and dynamic pumps based on the type of operating principle. Displacement pumps can be sub-classified as rotary and reciprocating pumps, while dynamic pumps can be centrifugal and special effect pumps.

Expanding the domestic market

The Indian pump and valve segment has registered significant growth in the past few years. Notably, the sector provides one of the highest net value additions (over 20 percent) in the engineering sector. It has matured significantly and domestic sales are increasing at the rate of 16-18 percent per annum. According to industry estimates, India produces about 4.5 million pumps per annum. As per the Indian Pump Manufacturers’ Association, the pump industry has a turnover of about ₹200 billion. The segment has around 800 manufacturers making pumps of different capacities.

Indian pumps and valves are exported to more than 100 countries across the globe. The present market scenario suggests that export growth is likely to double in the next two years. India’s key export markets include the Middle East, North Africa, the US, Germany, Russia, China, and Latin America.

With regard to imports, Indian pumps and valves are sourced from the US, China, and France. The availability of low-cost models makes local manufacturers competitive and this has limited the inroads by Chinese products, especially in the agricultural sector. Also, the lack of adequate aftersales service has restricted the acceptance of Chinese supplies by industrial sectors.

The industry’s structure is characterised by a high level of market fragmentation with the presence of a few big players and a large number of medium- and small-sized players. There are over 800 domestic pump and valve manufacturers, and the industry employs over 1,20,000 people. Pumps perform two key functions — the transfer of liquids from one system to another and the circulation of liquids within a system. Some of the key components that determine the configuration of pumping systems are pumps, prime movers (electric motors, diesel engines or air systems), piping, valves (to control flows in the system), other fittings, controls and instrumentation, and end-use equipment.

Most of the pump market (about 95 percent) comprises centrifugal pumps, while the remaining 5 percent are positive displacement pumps. Agriculture and building services account for the major portion of demand at 46 percent of the market in terms of value, while the rest of the infrastructure sector together accounts for the remaining 54 percent. This segment of the pump market is technologically intensive and hard for small and medium enterprises (SMEs) to penetrate. Almost 95 percent of the country’s demand is met by domestic pump manufacturers and about 5 percent through imports. Thus, both Indian and foreign players play a role in the local market.

The pump industry comprises a few large players — both Indian and multinational companies (MNCs) — and many SME players. Some domestic SMEs have entered foreign markets such as Egypt, the US, West Asia, Greece, and Italy, while MNCs have either entered into joint ventures or made direct investments in the Indian market.

Recent developments in technology to improve pump and valve efficiencyTo take it further, Daniel Griffiths, Operation Manager, WEG Motors said, “Improvements in motor efficiencies, control and process analysis and the inclusion of IoT/Industry 4.0 will all assist the system designers in creating adaptive and efficient pump and valve systems.” The efficiency gains now being made can only be marginal, as hydraulic design is well-engineered from old-school engineers and well-developed in terms of software.

Brian Conway, Director, Pumps & Systems Ltd said, “The solution is to run a pump or multiple pumps at best efficiency point (BEP), or very close to it. It requires a good understanding of system demand variation, if any, and a detailed process description, followed by intelligent selection of a pump, or multiple pumps to operate at BEP. There is now a great opportunity for data gathering and the facilities for AI cloud-based systems, but there are very few providing real-time intelligent control to maintain assets at their optimum.”

Challenges caused by inefficiency of pumps and valves

Inefficiencies in pumping systems ultimately cost money. The obvious cost is energy, but the inefficient running of a pump or system also has an impact on asset life, maintenance intervals, reliability, and risk of failure. Richardson said, “Whilst costs are important for users and operators of pumps, the environmental impact of running inefficiently should not be ignored. On a global level, a huge proportion of the world’s electrical energy is consumed by pumps and they are the single biggest user of electricity in the EU, so the opportunity to make a difference in CO2 savings and energy reduction is massive.”

Poor selection, control and maintenance are key areas which present the most challenges to pump users, as the plant equipment can often be in remote or inaccessible locations or have such a wide and changing requirement that it can be difficult to keep a pump system running at its optimum. Griffiths said, “These factors often result in expensive, rushed repairs and an overreaction for highly sophisticated control and monitoring solutions.” Even pumps designed and installed more than 50 years ago are very efficient, and if they are selected correctly for the system, they will provide and maintain almost as-new efficiency and long-term reliability of wearing and non-wearing components.

To which Conway elaborated, “When a pump is taken outside of its preferred operating zone, then you are inviting increased stress, vibration, wear, recirculation, etc. as compound interactive issues, which will increase maintenance costs and reduce reliability. If we look outside of the effect on the pump, the annual energy cost over the life of the pump is a hidden cost, often not seen within the budgets of those that can affect it.”

Solutions to enhance efficiency

Society generally sees technology as the solution and there is no doubt that technology is advancing. It is allowing us to increase efficiency at a component level, but we sometimes are obsessed with ‘new stuff’ and tend to focus on that rather than utilising the tools that we already have. According to Richardson, “I think the biggest gains in terms of gaining efficiency from pumping systems actually come down to how these systems are really operated and used. The interaction of components and how individual items can be combined to increase efficiencies is important, but designers often have limited control over how the system actually operates after it is commissioned.”

Further Griffiths says, “A simplistic and practical approach to any pump solution is often the most effective at maintaining an efficient system, asking good questions about the requirements of the pump system, planning for expansion, redundancy and duty control and understanding the demand profile are vital to creating an efficient control system which matches the requirements of the system.”

Pumps are almost at their peak in terms of efficient design, but there is a long way to go in terms of a sustainable, optimised and reliable system. The pump needs to match the system, either through confident engineering methodology, or practical system testing and analysis, and intelligent operation.

Conway says, “Being able to understand the interaction of pump characteristics with system characteristics enables intelligent design, control and operation.” Many in the industry who operate pumps do not understand what they are operating because they haven’t been given the right training. Investment in training will provide enormous benefits to intelligent, operational pump efficiency and enable greater development of the market.

Whilst costs are important for users and operators of pumps, the environmental impact of running inefficiently should not be ignored.

Martin Richardson, Water Framework Manager, ABB

Improvements in motor efficiencies, control and process analysis and the inclusion of IoT/Industry 4.0 will all assist the system designers in creating adaptive and efficient pump and valve systems.

Daniel Griffiths, Operation Manager, WEG Motors

The solution is to run a pump or multiple pumps at best efficiency point (BEP), or very close to it.

Brian Conway, Director, Pumps & Systems Ltd

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.