Better tariff, govt schemes to propel wind sector: IWPA

By EPR Magazine Editorial August 27, 2020 11:11 am IST

By EPR Magazine Editorial August 27, 2020 11:11 am IST

At a hub height of 100 metres, India has a wind energy potential of 302 GW; by increasing the hub height by another 20 metres, the potential will more than double to 695 GW. The opportunity, therefore, is huge.

Prof. Dr. K. Kasthurirangaian, Chairman, Indian Wind Power Association (IWPA)

Though the main bottleneck for wind energy deployment is the existing policy framework – both at the central and state levels, Prof. Dr. K. Kasthurirangaian, Chairman, IWPA believes, “With better tariffs and with government’s recent initiatives, we are likely to fare better compared to the last few years.”

Now that the Indian government targets 510 GW RE by 2030, where do we stand today?

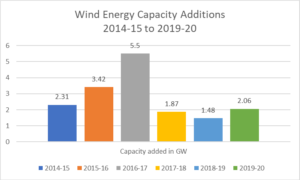

We are glad to see that the target of 60 GW of hydro-electric power by 2030 has now been added to the earlier renewable energy (RE) target of 450 GW. Out of the 510 GW target, wind energy is to contribute 140 GW. As of 31st July 2020, the operational installed wind energy capacity is 37.94 GW. That leaves India in a position where 102.06 GW of wind energy is to be installed in 10 years, i.e. about 10 GW per year. But in 2019-20, we added only 2.06 GW. Wind installations added in the previous years were 1.48 GW in 2018-19 and 1.87 GW in 2017-18. What is relevant though is that in 2016-17, India added a massive 5.5 GW of wind energy capacity. India thus has the capability to scale up and meet the challenge.

At current prices, the investment required to install such a capacity would be to the tune of around Rs. 6.12 lakh crore per GW. Though the government has allowed 100 percent FDI in the RE sector under automatic route, the FDI received was only a fraction of the requirement, viz. Rs 11,053 crore in FY 2018-19 and Rs 9,700 crore in the first nine months of FY 2019-20. These figures pertain to the RE industry as a whole.

What is the main bottleneck for renewable energy deployment in India?

Rather than speaking for renewable energy as a whole, the Indian Wind Power Association (IWPA) shall restrict itself to talking about wind energy deployment. The main bottleneck for wind energy deployment is the existing policy framework – both at the central and state levels. To illustrate:

What’s your take on the recent performance of India’s wind power sector? Is it making a comeback after a temporary slowdown?

The prospects are relatively better for the wind sector. The pace is steady now, after a state of flux and then of stagnancy. Till 2017, with government’s fiscal incentives coming to aid, a majority of the capacity addition happened because of investments by the small and medium segment of industries, especially for captive consumption. When independent power producers came on the scene, capacity addition showed a steep increase after 2013, peaking at 5.5 GW in 2017.

With the first reverse bid SECI auction in 2017, the scenario changed. The lower rates being quoted pushed the SME investors out of the scene. However, the situation is now improving given that tariffs have begun to increase to more realistic levels in the recent bids. With better tariffs and with government’s recent initiatives, we are likely to fare better compared to the last few years.

What’s your revival strategy?

The revival strategy focuses on the fundamentals – minimise investment risk, maximise return on investment. However, this is easier said than done. Minimising investment risk involves addressing issues like delayed payments to generators by DISCOMs, honouring PPA terms, intermittency and regulatory inconsistencies; maximising return on investment involves substantially increasing evacuation of wind energy, enhancing Capacity Utilisation Factor (CUF), realistic tariff fixation, reducing costs etc.

A point to be made is that by 2050, the International RE body IRENA projects that 86 percent of the world’s energy demand will be met from RE sources – 8,500 GW would come from solar power and 6,500 GW from wind power. At a hub height of 100 metres, India has a wind energy potential of 302 GW; by increasing the hub height by another 20 metres, the potential will more than double to 695 GW. The opportunity, therefore, is huge.

India’s per capita energy consumption at 1,149 kWh is just around 50 percent of the world average. With the advent of electrical vehicles, the government estimates that per capita consumption in India will double by 2030. Further, taking into consideration India’s demographic dividend of having a large population under 30 years of age, all with aspirational growth targets, the per capita consumption is likely to go up even further. So, apart from opportunity, the market for energy is also there.

In order to seize market share, there is a need to view the challenges faced holistically and to address them through systemic interventions. Using such an approach, IWPA is collaborating with all stakeholders, the focus being on recreating an enabling business environment that addresses the fundamentals – minimising risk and maximising return on investment.

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.