Emergence of Power Market Design, and critical role of analytics & automation as enabler

By EPR Magazine Editorial February 4, 2022 6:50 pm IST

By EPR Magazine Editorial February 4, 2022 6:50 pm IST

With the Spot and STOA markets playing a pivotal role in the new evolving market design and the likely launch of electricity derivatives, analytics is a key driver in trading and planning decision making.

Indian Power Market is making strides towards next level transition, which will likely be completed in the next 3-6 years. The focus of this transition is to have a competitive market mechanisms and institutions centred around digitisation and Information Technology to bring-in scale, speed, transparency and standardisation.

Leading the world against climate change, India focuses on clean energy’s mass deployment. Solar and wind are currently the dominating clean energy sources, which comes with their complexity in uncontrollable generation and intermittency. With climate change impacting the major weather patterns, solar and wind generation estimation is more complicated. In addition, the recent coal crisis triggered by prolonged monsoon, is a kind of another effect of climate change. Given the aggressive clean energy transition of the Indian power system, which is bolstered by the recent commitment of India at CoP26 for achieving Net-Zero carbon emissions by 2070, our power market design has to evolve rapidly to accommodate the transition.

As such, the policy and regulatory environment is driven towards competitive market mechanisms to take up the next-gen reforms by way of reduced dependence on LT PPAs, accommodating the uncertainty of RE generation, upgrading load dispatch operations to handle high RE penetration and scale, introduction of new spot-markets like RTM, G-TAM, G-DAM, market-based DSM mechanism etc., and moving towards GNA for transmission allocation and pricing, in addition to MBED, long duration PX-based STOA contracts, derivatives, market-based ancillary mechanisms and capacity contracts.

Conventionally the wholesale power market is dominated by a few large buyers and sellers with capacities >100MW and has limited participation from small C&I players through Open Access. Transactions in the market are largely LT PPAbased (90 percent), while the rest are done through shortterm mode of collective (DAM/RTM), bilateral and DSM segments, which are more competitive and transparent. High RE penetration brought new dynamics like technology cost changes, intermittency and dispatchability, geographical and temporal diversity, installation time, smaller capacity, ancillary requirements, and weather dependency.

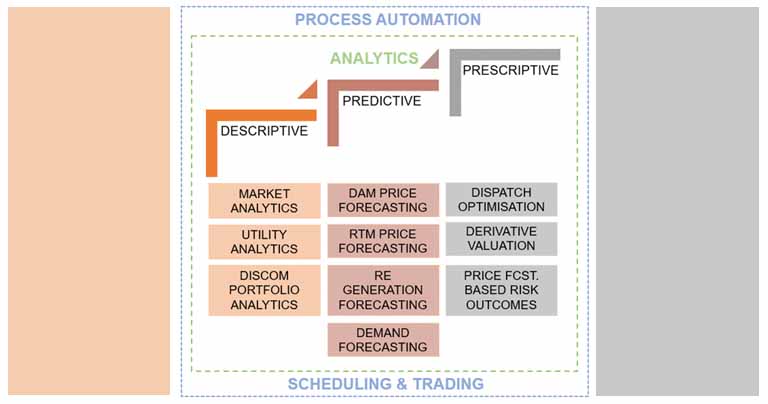

Big-Data Analytics gained a prominent role in all sectors in this digital age. With power sector operating within 15-minute time-block resolution for energy accounting and sometimes 30 seconds resolution, colossal data is generated on a real time basis from millions of supply-demand grid-connection points through RTUs and ABT/SEM meters and trading and scheduling activities. With Spot and STOA markets taking the pivotal role in the new evolving market design and the likely launch of electricity derivatives, analytics play a key driver in decision making for trading and planning activities as qualitative and experience-based traditional approaches have become inefficient. Analytics is classified into descriptive, predictive and prescriptive analytics, and each has a sound relevance to the power market, especially in planning, scheduling and trading activities.

Power market is a national market, with hundreds of players millions of supply-demand; price-volume data points are generated on a 15-min. time-block basis. DSM is now linked to DAM prices, while STOA bilateral and banking transactions are benchmarked primarily to DAM prices. Withs of LT Plants taking place on the day-ahead basis in sync. With DAM and Gate Closure for revisions linked to RTM Gate Closure, the PLF of LT PPA-based plants is now in the realm of Spot Market Liquidity and prices. Investors have started to factor-in Spot Market Prices in deciding their generation investments. This requires a strong need to understand the national market’s past and present influencers. This understanding must be complemented by descriptive analytics-based tools where a wholistic national model of market prices-volume and supply demand parameters can be used. This analytics uses data aggregation and data mining to understand and uncover trends quantitatively, thereby gaining valuable insights on the parameters influencing market prices and taking well informed and strategic decisions in planning and trading activities.Descriptive analytics also plays a crucial role in DISCOMs for portfolio and energy management activities, given the scale of supply-demand side interactions, scheduling, regulatory compliances, market mechanisms and real-time SCADA and Meter data makes it complex to understand and navigate the market-centric operations to make the right decisions and serve load optimally. A unified descriptive analytics based platform will help understand and assess the techno-commercial aspects in meeting supply and do a post-facto analysis for corrective actions. Real-time big-data analytics tools help manage a unified analysis of all the inter-linked techno-commercial parameters of DISCOM on a near-real-time basis, eliminating lag, aiding both operations and management in effectively understanding their respective portfolio holistically and take timely informed decisions. Regulators can also use such Descriptive Analytics platforms to monitor and assess the performance of regulated entities in this area on a near-real-time basis.

Lack of such Descriptive Analytics Platforms with DISCOMs and Generators that primarily rely on the experience-based decisions of operations and trading personnel leads to poor trading and planning decisions. Regulators are in a handicap to independently monitor the performance of DISCOMs w.r.t trading and planning efficacy and optimality, that too promptly. With scalable best-in-class cloud-based technology tools for Data Analytics and Business Intelligence widely available in recent past years, even for small-scale applications, power market players can adopt these technology enablers for moving to a big-data based quantitative trading and planning paradigm.

Finally, Prescriptive Analytics supports in providing actional decision-making inputs with result-based insights. It draws heavily from descriptive and predictive analytics and uses statistical approaches for providing scenario-based outcome analysis. Power Markets’ two key areas are Scheduling/Dispatch Optimisation and Derivative Contract Valuation/Market Risk Assessments. Globally, Linear Programming-based Optimisation tools (Energy Market Management Systems/EMMS tools) are used by load serving entities/DISCOMs and system operators to optimise schedules/dispatch supply for the least cost and trade optimisation.

Automation is another critical area neglected in Power Market related areas, where significant strides were made at NLRC/RLDC end, power exchanges and to some extent, at the level of traders. With near-real-time trading and scheduling coupled with a considerable amount of data, diversity of suppliers and market mechanisms, collation of various data points and readings for analysis to make near-real-time decisions, coupled with the need to analyse the extraneous market eco-system (as power market is mainly national level), there is a need to tap 30-100 data sources for a DISCOM, that too will little or no API support from the eco-system players. Hence, for effective decision

making, there is a need to do away with manual based data collation, compilation and communication activities, which occupies most of the productive time of scheduling and trading teams in control rooms. With the growing complexity of markets and regulatory compliances, there is a need for automation to take up the unnecessary and unproductive data extraction and compilation and communication activities using IT tools for process automation and communications. Cloud-based automation tools, including Robotic Process Automation, are available even for small scale applications, which will ease out most of the processing time for the operations team, and thereby provide the scheduling and operations teams with error free information and analysis for decision making, and thus will enhance the productivity and decision-making capability of the team multifold.

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.