The need for distribution transformers is influenced by transformations in energy sector

By EPR Magazine Editorial May 2, 2022 10:16 am

By EPR Magazine Editorial May 2, 2022 10:16 am

Favourable government policies in India made in accordance with the increasing energy demand is likely to drive the Indian distribution transformer market.

Power transformers are used in transmission networks where there is an issue of higher voltage and operate on full load rating with minimal load fluctuations.

On the other hand, distribution transformers are used in distribution networks where there is an issue of lower voltages, and functions at a significantly lower load. The variation in the loads varies substantially. Power transformers are a common feature in power generation stations and transmission substations, while the installation of distribution transformers is mainly in distribution stations.

The India distribution transformer market is expected to register a CAGR of more than 4.56 percent during the forecast period of 2022-2027. The Covid-19 pandemic has shown a negative impact on India Distribution Transformer Market. The lockdown measures have impacted the financial health of power distribution companies. The distribution transformer manufacturers have faced the struggle to manage their operational and financial bases, as a result, number of operations were halted.

Factors such as increasing energy demands from the industries and expansion of transmission and distribution networks along with the growth in the renewable energy sector is likely to drive the India distribution transformer market. However, delay in the implementation of the projects due to lengthy government procedures is expected to restrain the Indian distribution transformer market during the forecast period.

Key highlights

Due to its increasing number of new small power rating substation projects across the country, below 500 kVA distribution transformer segment is expected to be the fastest growing segment for the India distribution transformer market during the forecast period.

A smart grid is seen as a highly efficient and economical technology that can reduce carbon emissions. Such upgradations for existing networks in the country is likely to create immense opportunities for the market soon.

Favorable government policies in India made in accordance with the increasing energy demand is likely to drive the Indian distribution transformer market.

Key Market Trends

Below 500 kVA capacity to witness significant growth

The distribution transformers with the capacity below 500kVA are mainly used in residential and light commercial applications. A single-phase type transformer dominates these distribution transformers.

The residential electricity consumption in the developing countries is significantly lower than the global average, owing to lack of access to electricity and fewer electronic equipment per household, compared to developed countries.The increasing access to electricity in the rural areas, particularly in India, owing to the increasing government initiatives, such as Saubhagya scheme and Power for All that aims to connect all households, is expected to increase the demand for below 500 kVA distribution transformers.

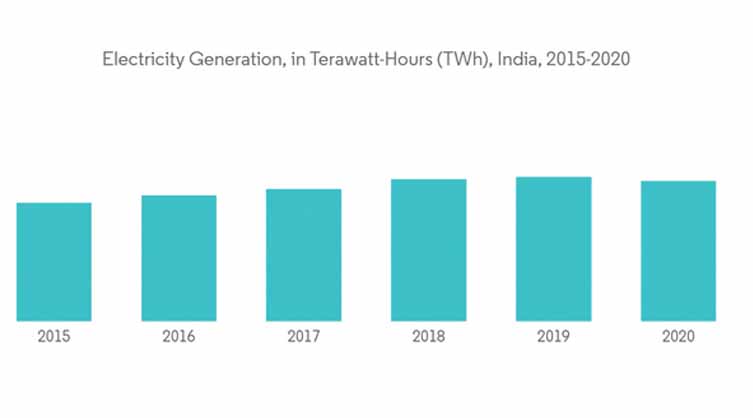

As per the statistical report by Mordor intelligence, in 2020, the electricity generation for India was about 1560.9 TerawattHour (TWh), which was higher than what the country produced in 2015, 1317.3 TWh. The increase in electricity generation exhibits an increase in the number of power generation stations, which are likely to use new distribution transformers for supply of electricity to the consumers.

Additionally, in October 2021, Sterlite Power, a private sector power transmission and solutions provider has been awarded the Nangalbibra-Bongaigaon interstate power transmission project worth USD 43.446 million through tariff-based competitive bidding (TBCB). The project is likely to have 20 km of 132kV D/c line connecting Hatsinghmari in Assam to The need for distribution transformers is influenced by transformations in energy sector Favourable government policies in India made in accordance with the increasing energy demand is likely to drive the Indian distribution transformer market. 36 MAY 2022 Electrical & Power Review INDUSTRY REPORT Ampati in Meghalaya and requires number of below 500 kVA rating transformers to step down the power supply.

Hence, owing to the above points, below 500 kVA capacity segment is likely to witness significant growth for the India distribution transformer market during the forecast period.

Favourable government policies to drive the market

India’s power sector is undergoing a wide-scale transformation, as the country is facing steep electricity demand growth rates. Several parts of India witness high power cuts due to the growing demand for electricity and the supply gap. To address the issue of electricity reliability, the government has implemented policies to increase electricity generation and encourage consumers to reduce their consumption during peak hours.

In the fiscal year 2021-22, the Indian government had proposed to launch a reforms-based result-linked power distribution sector scheme worth approximately USD 50 billion. The project provides assistance to DISCOMs for infrastructure creation, including pre-paid smart metering, feeder separation through distribution transformers, and upgradation of existing systems.

In the recent years, the government has launched several schemes, such as the Deen Dayal Upadhyaya Gram Jyoti Yojana (DDUGJY), Integrated Power Development Scheme (IPDS), and National Electricity Fund (NEF), to improve the distribution sector in the rural and urban areas.

Moreover, government policies towards the rapid increase in renewable energy installations at different sites require the installation of distribution transformers to step down the electrical voltage at substations, thus, driving the market demand. In 2020, the total renewable energy installation in the country was 134.197 GW, which is higher than its installation in 2019, i.e., 128.238 GW.

Hence, owing to the above points, favourable government policies are expected to drive the India distribution transformer market during the forecast period.

The country’s government’s push toward renewable energy sources, a boom in demand for green transformers, and the growing need to modernise the country’s existing grid infrastructure are all projected to drive market growth in the next years.

Aside from that, market growth is predicted to quicken in the next years as a result of factors like as the country’s growing urban population and a surge in economic activity, both of which are driving up demand for energy.

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.