Setting small hydro projects and hydro-pumped storage systems in India

By EPR Magazine Editorial September 2, 2022 4:35 pm IST

By EPR Magazine Editorial September 2, 2022 4:35 pm IST

Hydro, once touted as the sustainable and renewable alternative to coal, has slowly gained a lot of ground in the last couple of years with the addition of renewable power to the national grid. India’s commitment to COP26 is to attain net zero by 2070 and gain a renewable energy capacity addition of 500 GW by 2030.

Globally, hydropower is a key clean, renewable energy source. With an installed base of about 49 GW and an additional 4.5 GW from small hydropower, India is well-positioned to continue growing. The ambitious goal of India to add 175 GW of renewable energy capacity by 2022 is roughly on track. With such a massive increase in RE capacity through the grid, connectivity would be necessary to maintain grid stability over the years. It plans to increase the proportion of installed renewable capacity to 50 per cent of the total generation capacity by 2040.

In the last 4-5 years, we witnessed a complete sluggishness in the hydropower sector. The main reasons were geological surprises in ongoing projects, leading to excessive delays and project cost overruns. This was coupled with no new financing coming into the sector. Hence, certain projects were nearly declared as NPAs, and creditors filed for recovery through the National Company Law Tribunal. However, now the trend is focused on Pumped Storage plants (PSPs), the most sustainable energy storage techniques required to mainly maintain high reactive power in the grid in the event of fluctuations coming from variable renewable energy sources like solar and wind. The current trend is probably going to last for the foreseeable future. Peak demand is predicted to rise by 110 GW over the next ten years, compared to a base demand increase of 70 GW.

Power generation nowadays is characterised by the following features:

The number of small hydro project locations identified is 1001, and 320 have been installed with a combined capacity of 3832 MW. From this, private developers are producing 1662 MW (IPPs).

In Arunachal Pradesh, the recent MOEF & CC clearance of NHPC’s Dibang HEP (2850 MW) has witnessed some movement. In the southern states of Tamil Nadu and Karnataka, we expect life extension initiatives of various aged hydro plants, which have an average life of 55 years and are in dire need of renovation and modernisation. With the increase in RE capacity, we expect to see movement on hydro pumped storage schemes (PSPs). Namely, projects like Turga PSP (1000MW), Sheravathy PSP (2000 MW), NREDCAP identified projects, and a few more large-sized projects are expected to be commissioned by 2025. Rangit-II (120 MW) in Sikkim, which an IPP was previously developing, was finally reprieved through NCLT, and NHPC is developing the project. Much-needed funding seems to be one of the many impedances being faced in the hydropower sector at the moment. With the recent amendments to the hydro policy, we might have to wait till backlogs clear up, and we see a slew of projects coming up for development by 2024.

Expertise shared by:

Neelav Samrat De,

General Manager &

Head of Department

Market Management,

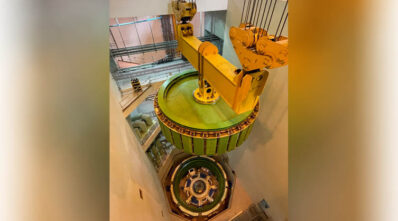

Image Courtesy: “ANDRITZ Hydro” ANDRITZ Hydro, New Delhi.

Disclaimer: (The views and expressions in the article are the sole of the author and do not reflect the views of the company in any way.)

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.