India’s clean energy goals create investment opportunities for BESS and green hydrogen

By EPR Magazine Editorial February 10, 2023 3:44 pm IST

By EPR Magazine Editorial February 10, 2023 3:44 pm IST

India’s installed renewable energy capacity stands at 166.4 gigawatts (GW) (including large hydro) as of November 2022. The sector has grown exponentially over the last decade. The Indian government’s reforms, policies, and an overall pro-business environment have facilitated the growth of the renewable energy sector. These measures, coupled with a constant deflation in critical renewable energy technologies’ costs, have helped India record an all-time low solar tariff of Rs1.99/kilowatt-hour (kWh) in 2020. However, recently, several headwinds, such as the rising module prices and increased taxes and financing costs, have changed the sector leading to an increase in discovered tariffs to Rs2.9/kWh.

The sector’s growth has attracted investors from all quarters of the global financial markets. Over the years, domestic clean energy players have raised substantial amounts of capital, both debt and equity, to fund their expansion plans. On the debt side, Indian companies have extensively raised green and sustainability-linked bonds and loans. On the equity side, the sector has had increasing interest from mature long-term passive investors such as sovereign wealth funds (Abu Dhabi Investment Authority and Singapore’s GIC) and pension funds (Canada Pension Plan Investment Board and Caisse de dépôt et placement du Québec (CDPQ)). With the exit of several early investors and many capital recycling opportunities available, the Indian renewable energy market has matured to attract global capital.

Government reforms over the past decade have improved business conditions for the clean energy sector in India. This has also helped create a diverse set of domestic and offshore capital sources available for sector players. Industry players are getting ready to ride the next wave of sectoral reforms to accelerate India’s growth as a sustainable energy economy. These reforms include the General Network Access (GNA) regulations, green energy corridor scheme, Production Linked Incentive (PLI) schemes, state electricity distribution companies (DISCOMs) privatisation bids, ancillary regulations and the green hydrogen/green ammonia policy.

Scaling up renewable energy should give confidence to industry players and potential investors.

The success of these reforms hinges on the government’s ability to weed out implementation bottlenecks, facilitate the availability of long-term competitive finance and ensure that the concerns of industry players are duly addressed. India’s success in scaling up renewable energy should give confidence to industry players and potential investors in this context.

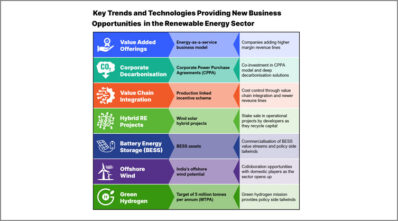

Emerging trends in the renewable energy sector

Along with developments in generating, distributing, and transmitting renewable energy business models, value-added products and services such as Energy-as-a-Service and corporate decarbonisation solutions are evolving rapidly. While Tata Power has rolled out a turnkey package of energy efficiency services, JSW Energy and ReNew Power are providing on-demand firm dispatchable power for their customers. Greenko, too, recently rolled out cloud energy storage solutions offering on-demand storage to its customers.

Corporate decarbonisation is another growing trend buoyed by increasing net-zero commitments by Indian companies. Corporate Power Purchase Agreements (CPPAs) are a win-win proposition for independent power producers (IPPs) and corporates. The CPPA market is yet to reach its full potential. The rectification of hurdles, such as delays in the approval of projects and withdrawal of waivers on various charges, will play a prominent role in fulfilling its promise.

For deep decarbonisation, industry players are exploring the many use cases of green hydrogen with several projects and partnerships in storage, mobility, industrial supply, and natural gas blending.

With a target of 25% share of the power exchanges by 2024, the short-term and merchant markets are also growing rapidly. Market-based reforms, along with integrating the national grid and multiple projects underway to strengthen the interstate transmission system (ISTS), provide tailwinds for the sector’s growth. This could lead to companies keeping merchant or un-tied renewable energy capacities to trade through the exchanges.

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.