Changing BESS landscape in India

By EPR Magazine Editorial December 6, 2024 12:49 pm IST

By EPR Magazine Editorial December 6, 2024 12:49 pm IST

Self-sufficiency in battery storage is crucial for energy security, cost reduction, and sustainability. Key policies like incentivising domestic lithium mining, supporting R&D in alternative batteries, and promoting manufacturing hubs via PLI is boosting the sector.

From Imports to Innovation: Transforming India’s BESS Landscape

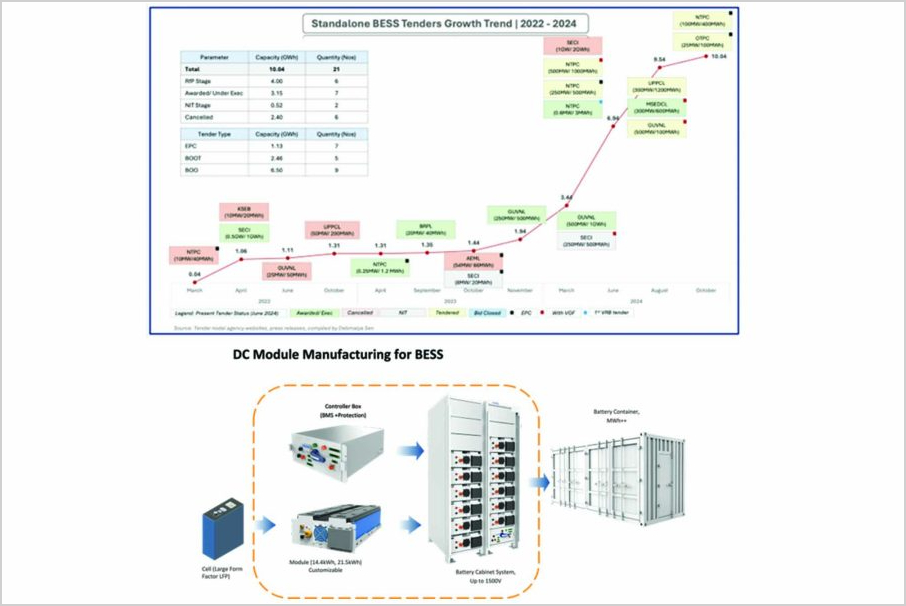

Growth of Battery Energy Storage Market for India

Battery energy storage is highly attractive in the Indian market due to the country’s rapid renewable energy expansion and need for grid stability. It offers a solution to intermittent power supply by storing solar and wind energy, ensuring reliable electricity access, reducing dependence on fossil fuels, and supporting India’s energy transition and sustainability goals.

Heavy Import Dependency for Battery Energy Storage Systems:

In the 2023 financial year, India imported $3.59 billion worth of batteries and accumulators, with $2.6 billion coming from China and $300 million from Hong Kong. India is one of the world’s biggest importers of lithium-ion batteries, and imports them from countries like China, Japan, and South Korea.

India’s lithium cell imports have surged in recent years, driven by demand in electronics, electric vehicles, and renewable energy storage. Recent trends indicate continued high demand due to India’s ambitious renewable energy and EV targets. This dependence highlights the need for domestic manufacturing and raw material sourcing to achieve energy security and economic resilience

India faces several challenges with lithium battery imports, impacting its energy and manufacturing sectors. First, dependency on imports increases costs, as India lacks sufficient lithium reserves and relies heavily on countries like China, which dominate the lithium-ion battery supply chain. This dependency exposes India to geopolitical risks and supply chain disruptions, affecting prices and availability. While the government has implemented policies to boost domestic battery production and research, India currently faces a significant supply-demand gap, hampering its goals for renewable energy adoption and electric vehicle expansion.

Need for Self-sufficiency:

Self-sufficiency in battery energy storage is essential for India’s energy security, cost reduction, and sustainability goals. Key policy interventions include incentivizing domestic lithium mining and recycling to reduce raw material dependence. Government support for research and development in battery technology, including alternatives like sodium-ion and solid-state batteries, is critical. Establishing battery manufacturing hubs through Production Linked Incentives (PLI) can attract investment and scale up local production. Simplifying import regulations on essential raw materials and fostering public-private partnerships for technology transfer will also accelerate growth. Additionally, policies supporting grid-scale storage installations can stimulate demand and foster a robust domestic battery ecosystem.

The DC (Direct Current) module in a Battery Energy Storage System (BESS) is the component responsible for managing the flow of direct current electricity between the battery cells and other system components. It includes critical elements such as battery packs, battery management systems (BMS), and DC/DC converters, each serving a specific function within the energy storage process.

The DC module connects with an inverter to convert DC to AC for grid applications or DC-coupled renewable sources, such as solar panels, making it an essential part of BESS infrastructure, especially for renewable integration and grid support.

Potential advantages for Indian Battery Manufacturers:For Indian battery manufacturers, bidding on Battery Energy Storage System (BESS) tenders offers several advantages over imports from China:

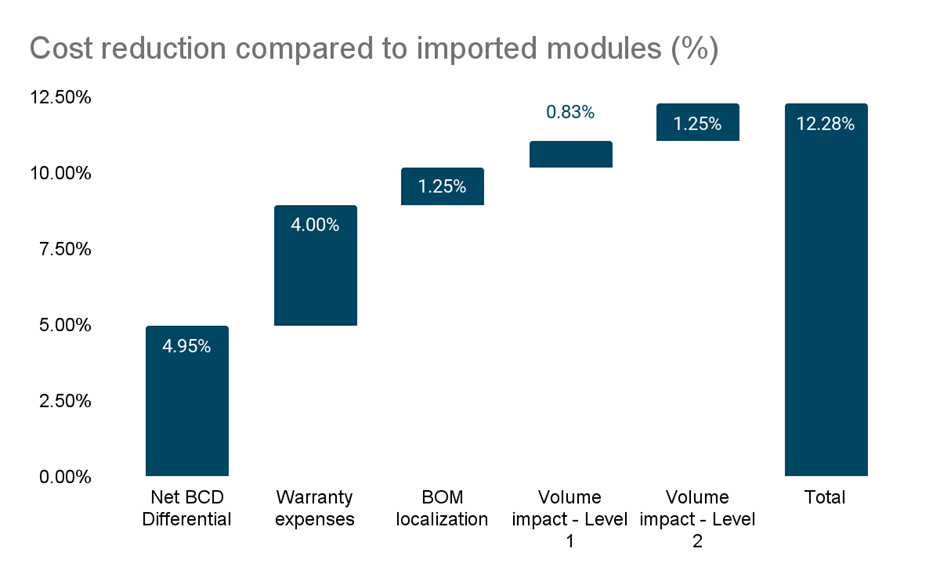

As shown below, manufacturing of DC Blocks for BESS can result in a module cost reduction of up to ~12% at prevailing BCD and will increase as higher differential BCD for modules is introduced. Break-up of this would be a) 4.95% lower cost due to existing duty differential b) Lower warranty expenses at scale on account of localized servicing c) Level-1 (i.e. volumes up to 100 MWh) to improve savings by ~0.83% d) Level 2 (i.e. volumes above 100 MWh) to improve savings by an additional 1.25%

Learnings from Solar:

India’s solar success offers valuable lessons for scaling the energy storage industry. First, government incentives such as subsidies, tax breaks, and Production Linked Incentives (PLI) can attract investments and lower costs, as they did for solar PV manufacturing. Secondly, creating favourable policy frameworks, including simplified regulatory procedures, will encourage private sector participation. Public-private partnerships, like those used in solar parks, can accelerate battery manufacturing and deployment. Additionally, leveraging bulk procurement strategies can lower costs and make storage affordable. Finally, a focus on R&D and skill development in storage technologies can establish a domestic talent pool, ensuring long-term industry growth.

Inverted Duty Structure:

In India, lithium battery imports currently face distinct duty structures. Lithium-ion cells, a major component of batteries, generally attract a 5% import duty, while assembled battery packs see an import duty of around 10% to 20%. However, to support domestic manufacturing, the government has waived customs duties for specific machinery used in making lithium-ion cells. This initiative aligns with the Production-Linked Incentive (PLI) scheme that offers subsidies for local production, aiming to reduce reliance on imports and boost domestic capacity for battery cells and packs

Recommendations:

To strengthen India’s energy storage ecosystem, it is recommended to increase customs duty on imported battery modules, thereby encouraging local manufacturing and reducing import dependency. Implementing an Approved List of Models and Manufacturers (ALMM) equivalent for battery makers would also help ensure quality and standardization in battery storage technologies, similar to its impact on India’s solar industry. Additionally, extending the Production-Linked Incentive (PLI) scheme specifically to Battery Energy Storage Systems (BESS) manufacturers would stimulate local production and attract investment. These steps would help India develop a robust battery manufacturing base, enhancing energy security and aligning with renewable energy goals

Authored by : Venkat Rajaraman , Founder/CEO – Cygni Energy

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.