Managing energy transition risks

By EPR Magazine Editorial November 15, 2024 4:07 pm IST

By EPR Magazine Editorial November 15, 2024 4:07 pm IST

Energy transition is a strategic shift to low-carbon or renewable sources to address climate change and ensure long-term energy security, but it is also fraught with multiple challenges. The authors believe that using an Enterprise Risk Management (ERM) framework can help develop comprehensive strategies to address such challenges

Energy transition is a strategic shift to low-carbon or renewable sources to address climate change and ensure long-term energy security, but it is also fraught with multiple challenges. The authors are of a view that using an Enterprise Risk Management (ERM) framework can help develop a comprehensive set of strategies to address such challenges.

Energy transition refers to the shift from fossil fuels to low-carbon or renewable sources. It also involves decarbonizing industries such as processing, manufacturing, transportation, utilities and construction. India has chosen an energy transition path to meet 50% of its electricity demand from renewables with an installed RE capacity of 500 GW by 2030, and achieve net-zero emissions by 2070.

Energy transition has to deal with technological limitations, capital availability, policy constraints, social and workforce issues. The involvement of multiple stakeholders noted below, whose interests often clash with the goals of energy transition, makes it even more complicated:

Risks and Challenges of Energy Transitio

These can be broadly classified as:

Energy transition requires adoption of renewable energy sources across all sectors with significant upfront investment and possibility of market risks e.g. demand volatility, supply chain constraints and cost escalations.

Government policies can help attract financing and investments in clean energy and decarbonization projects. However, subsidies on fossil fuels can be a risk to competitive pricing of renewable energies.

Transitioning away from fossil fuels could risk jobs. Re-skilling, upskilling and re-employment opportunities in the clean energy sectors could largely mitigate the social risks. Mining of materials needed for RE generation can impact the environment and community.

4.Technological risks

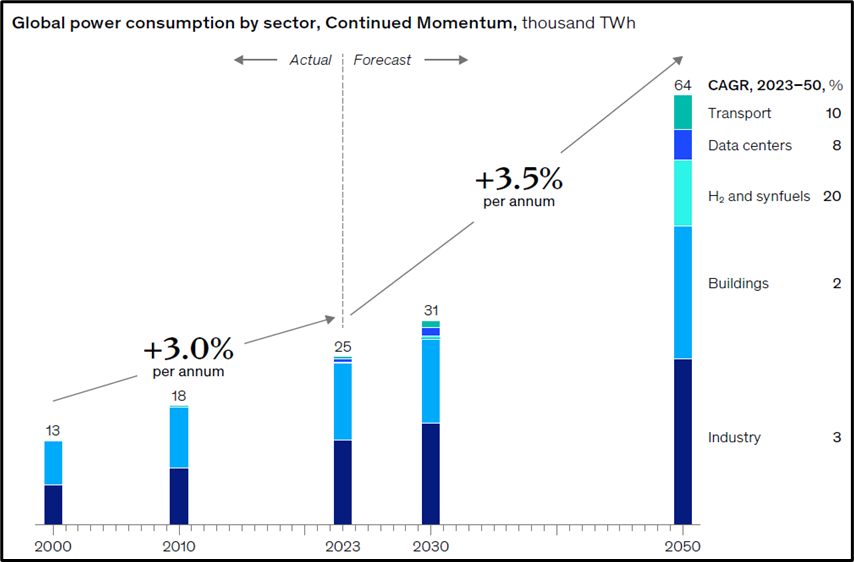

A hybrid mix of RE options (e.g. solar, wind, hydro, biomass) are needed to manage the risks associated with intermittent generation. Decentralized, volatile energy sources pose a challenge to grid stability and security, which can be overcome by using advanced digital technologies. Use of digital technologies and artificial intelligence (AI) are adding to the energy burden of the data centers. Data centers could account for up to 4,500 TWh of electricity consumption by 2050 globally, equaling almost 8% of total electricity consumption.

India being a global IT hub will need to invest significantly in green data centers, powered by renewables, and supported by a resilient grid infrastructure.

India’s energy demand is rapidly increasing due to economic development and urbanization. As on Aug 2024, fossil fuels accounted for 54% of total electricity production in India, while clean energy sources (Nuclear, Hydro, Renewables) accounted for 46%. The grid needs to be strengthened and modernized to accommodate the rising RE connections and create transfer capacity, for which investments in new infrastructure would be required.

IEA estimates that India’s market in renewables, energy storage and low-carbon technologies by 2030 will be over USD $80 billion. Institutional support will be needed for the markets to access low cost, long-term financing, with policy support from the government.

Subsidies given on clean energy by the Indian government in FY 2023 was less than 10%, as against 40% for fossil fuels and most of the remaining subsidies were given for agricultural electricity.[1] To create a sustainable energy economy, the subsidy policy need to be revisited. Energy transition and equity have to be balanced, ensuring that the means of energy production are secure, sustainable and affordable. Phasing out of fossil fuels has to be done in a planned manner to avoid negative impact on jobs and livelihood. Creation of alternate jobs and reskilling of workers to suit the energy industry trends could prevent such risks.

Modernization of ageing electricity infrastructure, technology and capacity expansion to accommodate the growing RE industry would need capital investments to make the grid adaptive, resilient and secure. In another thrust area – the transportation sector, the bottlenecks in the adoption of EVs need to be addressed, e.g. relatively higher prices, dearth of charging infrastructure and indigenous mass production capacity of EVs and its components.

India is offering financial incentives and subsidies to promote the adoption of hydrogen, biofuels, and electric vehicles. Three crucial policy initiatives adopted by India are the National Hydrogen Mission (promoting the production and use of green hydrogen), National Policy on Biofuels (increasing the use of biofuels in the energy mix) and the FAME Scheme (incentives for Faster Adoption and Manufacturing of Hybrid and Electric Vehicles).

Hydrogen is emerging as a key player in energy transition in transportation, industry and power generation. Annual target of 5 MT of green hydrogen requires 135 GW of renewable energy capacity to power the electrolyzers, according to CEEW (Council on Energy, Environment and Water). Policy initiatives, advanced technologies for mass production of electrolyzers and affordable renewable energies can bring down the cost of green hydrogen. The National Green

Hydrogen Mission is aiming to make India a global hub for the production, use and export of green hydrogen and its derivatives, and become a market leader.

Biofuels:

Biofuels are derived from organic materials. India is targeting 20% bioethanol blending with petrol by 2025. India aims to intensify the use of biofuels in the energy and transportation sectors. The abundant biomass resources such as agricultural wastes, forest residues and urban bio-wastes can be turned into low-cost, low-carbon fuels, leveraging technologies such as biomass gasification, anaerobic digestion and bioethanol production.

Electric Vehicles (EVs):

The transport sector is heavily dependent on fossil fuels, accounting for 37% of the global CO2 emissions. However, the critical materials (e.g. Lithium, Cobalt and Nickel) needed for EV batteries are concentrated only in few locations raising supply concerns. There are also social and environmental risks associated with the mining of materials for batteries. Risks notwithstanding, there are huge opportunities in transport electrification and decarbonization.

Need for ERM framework for Energy transition

An ERM framework provides a holistic, integrated approach to identify, assess and manage proactively the risks of energy transition, even as it helps exploit opportunities, as described below:

Risk Identification: Identify risks across various areas – operational, financial, reputational, legal, and environmental.

Risk Assessment: Quantify likelihood and impact to help prioritize the risks. Regulatory changes, stranded fossil fuel assets and environmental risks rank high in terms of financial impact.

Risk Mitigation strategies:

Stakeholder Engagement: Facilitate structured dialogue with stakeholders to align interests, negotiate solutions, and build collaborative strategies.

Diversification: Diversify energy portfolios and invest in hybrid mix of renewables.

Scenario planning: Model different transition scenarios for risk mitigation.

Equity: Incorporate policies to ensure social justice and protect vulnerable communities.

Sustainability and ESG metrics: Incorporate environmental, social, and governance criteria into risk management.

Monitoring and Reporting: Monitoring of risks and mitigation strategies such as tracking of emissions and social impact of transitions (e.g. job losses, community displacement).

Adapting to Regulatory Changes: Stay agile and adapt to changes in regulatory environments.

Conclusion

Accelerating energy transition requires a multi-faceted approach involving economic incentives, green energy financing, technological innovation, robust planning, policy measures, and community involvement. A robust enterprise risk management (ERM) framework is the need of the times, to address the risks and challenges of energy transition, and take affirmative steps to combat the fallouts of indiscriminate socio-economic development and climate change, and ensure energy security and sustainability.

Authored by : Mr K Ramakrishnan,Mr Soubhagya Parija,Mr Jayant Sinha

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.