An outlook on global developments fueling offshore wind energy

By EPR Magazine Editorial May 6, 2022 2:04 pm IST

By EPR Magazine Editorial May 6, 2022 2:04 pm IST

Robust steps undertaken to subside coal-based power generation in developed nations and a favourable outlook in emerging economies has driven offshore wind energy market trends.

Offshore Wind Energy Market size valued at USD 23 billion in 2020 and is anticipated to grow at a CAGR of over 15 percent between 2021 and 2027. Ongoing shift from the conventional energy sources to renewable energy technologies owing to the implementation of strict environmental policies will positively encourage the market growth. Accelerating offshore opportunities coupled with the development of a robust commercial & industrial sector base will influence the product penetration.

On closer analysis of worldwide efforts to adopt cleaner sources of power generation, the approach and progress differs to some extent across continents. One thing found common, though, is the increase in understanding and readiness to build on the available wind potential and harness nature’s abundant sources to lower fossil fuel consumption. Notable companies including General Electric, Vestas, Siemens Gamesa, Enercon, Envision Group, Suzlon Energy, Enessere, Vattenfall and others have upped their efforts to enhance components like wind turbine power, towers and blades to meet distinct geographical requirements.

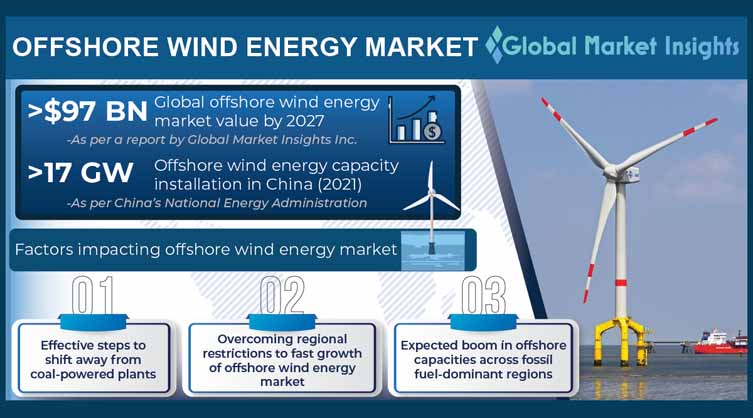

Understanding the scope of offshore wind energy industry over the coming years can be better achieved by observing the regional factors impacting it. Federal policies, building turbines suited to available resource, coal dependency and consumer sentiment are among the key elements fueling the market dynamics. According to Global Market Insights Inc., offshore wind energy market size could surpass US$97 billion by 2027.

Effective steps to shift away from coal-powered plants

According to a report published by ‘Global Market insights’, during the previous year, the coal capacity in the U.S. had reduced to 232 GW as compared to a peak of 340 GW around ten years ago. The pace at which the country has cut down coal dependence may not look significant, but it believes the ongoing efforts are enough to meet the targets set under the Paris Agreement on climate change.

Add to that, the U.S. DOE had reported around 35,324 MW capacity of offshore wind project development and operational pipeline as on 31 Dec 2021. The new government has also set the country’s first offshore wind energy capacity goal of 30 GW by 2030, indicating strong winds for market players to manufacture components in and around the region.

The COVID-19 crisis had put the country in a state of higher power demand and low supply, which led to increase in energy prices and might further impact stripping down of coal-based units. But wouldn’t this be the case for other nations as well? However, many other governments had already achieved a high percentage of coal dependency cut down, particularly in Europe.

According to the U.K. government, 40 percent of the country’s electricity generation was coal-based in 2012. This reliance had reduced to just 1.8 percent by 2020 and could become zero by 2024, if the regional authorities continue their work in this regard. As the coal generated power is considerably mitigated, U.K. is expanding its renewable energy sourcing, which accounted for over 43 percent of its power generation during 2020 with wind energy comprising 24.2 percent of the overall mix.

Both Scotland and England hold tremendous offshore wind potential and the respective governments have given green signal to multiple large scale offshore wind farm projects. This includes the Dogger Bank Wind Farm projects A, B, C, around 80 to 86 miles from England’s North East coast. To be completed in three phases, the combined project could lead to the largest offshore wind farm in the world, having 3.6 GW capacity that can power up to 6 million households.

In the European Union, hard coal production had reduced from 277 million tons in 1990 to 56 million tons in 2020, nearly 80 percent reduction. Apparently, a number of EU financial institutions had announced almost 40 policies in 2020 for restricting the use of coal, whereas several banks had confirmed they would stop financing new coal projects globally. The Paris Agreement has played a major role towards the undertaking of these initiatives.Albeit the regional outlook, some of the countries in the EU who are major coal users could miss the 2030 target of phasing out its application. This includes Germany and Poland, who comprise nearly 22 percent and 43 percent of EU’s total hard coal consumption, respectively. Germany is expected to phase out coal-based power generation by 2038, and some smaller countries have not yet formed a total phase out policy. A positive aspect to be noted is that Germany had an installed offshore wind capacity of 7.7 GW by the end of 2020, just behind the U.K. and China.

Expected boom in offshore capacities across fossil fuel-dominant regions

South Africa is among the leading carbon emitters in the region as 80 percent of its energy is generated from coal. It was a great relief for the nation during last year’s COP26 summit when member nations agreed on a deal to provide US$8.5 billion to the government for helping it end its coal dependency.

South Africa was already planning to cut down the contribution of coal in the energy supply to below 60 percent by 2030, with wind and solar based power generation to reach 25 percent by then. Although notable offshore wind projects in the country can be expected around 2030 and after, owing to major focus on onshore wind currently, increasing efforts to avoid coal consumption will certainly bolster the industry outlook.

In the previous year, Saudi Arabia had announced the connection of its first onshore wind farm to the grid, achieving a significant milestone. Nonetheless, majority of the Kingdom’s power generation is oil and gas based. With the country having its own Vision 2030 targets to follow, it is taking strides toward promoting both, onshore and offshore wind energy installations.

A 500 MW offshore wind farm is under development in the Kingdom through a partnership between Plambeck Emirates LLC and Saipem near the Persian Gulf. The floating wind farm will boost renewables industry development in the region and could encourage nearby countries to follow suit.

Despite being home to one of the largest offshore wind energy capacities in the world, China was expected to see a 9 percent y-o-y increase in coal-fired power generation in 2021, as per the IEA. The country’s government has made promises to cut down coal dependency after 2025, still additional capacity of coal-powered plants can be observed in the country until then to meet the high demand for electricity.

Nevertheless, the fact which is noted world-over is the nation’s commitment to expanding its wind power generation abilities. Referring to China’s National Energy Administration, the country was able to install more than 17 GW of offshore wind energy capacity during 2021, bringing its total to 26 GW, nearly half of the global installed capacity. Owing to the massive geographical area and population, China has found it difficult to dump coal-fired power plants, but its investments in offshore projects undoubtedly paints a strong picture for manufacturers of turbine components, floating platforms, undersea cables and maintenance equipment.

As evident, renewables investment and subsequent expansion of offshore wind capacities across the developed nations are in line with reduced utilisation of coal-fired power plants. Even though the COVID-19 pandemic slowed down infrastructure development globally, the forward strides in the direction of greener future were affected only slightly. In many parts of the world where fossil fuel dependency is still high, government policies and corporate actions will be defining the favourable outlook towards offshore wind energy industry over the next few years.

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.