Electric vehicles: An emerging clean transportation solution

By EPR Magazine Editorial March 28, 2020 3:38 pm IST

By EPR Magazine Editorial March 28, 2020 3:38 pm IST

Electric vehicles are being hailed as the modern answer to clean transportation, as polluting vehicles are slowly being done away with. We look at how the EV market has developed in recent years and what can be done to bolster growth.

As countries all over the world take steps to address climate change and combat pollution, electric vehicles are being resorted to as the new-age solution to these problems, while providing cost savings and other benefits. In India, there needs to be a dedicated awareness of the need to shift to EVs. It is now more than necessary for the shift to happen, as out of the 30 most polluting cities in the world, 21 of them are in India and there is a mandate to improve the air quality index which will eventually be good for the public and their future generations. We look at the latest technological developments and how the hurdles in market growth can be effectively mitigated.

Latest technologies and materials for EV affordability and efficiency

Niju Nair, Director – Business Management, ASEAN tells us, “The technology can be battery electric vehicles (BEVs), hybrid electric vehicles (HEVs) which use both electric and gas, extended range electric vehicles (EREVs) that are powered by battery for a certain number of miles and gasoline then powers an electric generator for the next several hundred miles of extended-range driving, and plug-in hybrid electric vehicles (PHEVs) that are a subset of hybrids which allow batteries to be recharged by plugging into an external electricity source.”

He adds, “In order to address the sluggish consumer demand in India, the strategy for vehicle makers (and retrofitters) could be launching affordable HEVs and PHEVs with good quality and efficiency to start with and a deliberate shift towards affordable BEVs. With up to 130 million BEVs and 90 million plug-in hybrid EVs expected on the roads globally by 2030 (compared to 3 million in 2017), some big changes are on the way for some major commodity metals and materials.

”

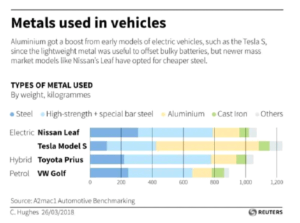

Nair further states, “The two key factors which determine the materials used for EVs are range and price. Aluminium is a favourite for body materials towards maximising range; however, its huge cost is driving vehicle makers to shift towards steel. Overall steel, aluminium and copper are going to be the key enabler materials for the surge in the future EV market. In India also, the preference will be steel as that remains cost-effective for BIW structures.”

Vishwas Vijayan, Director, Ultra Electric Company (India) Pvt Ltd, says, “Charging technology, electric motors and control and charging infrastructure of EVs play a vital role in the overall affordability of EVs. Range and charging time improvement will be the most exciting trends to watch out for. Super charging stations, portable charging solution and even battery swapping options are being explored.”

Akshay Kashyap, Founder and Managing Director, GreenFuel Energy Solutions shares, “Any new technology takes time to be affordable. What you will find is the early adopters and then it will trickle down to the masses. In my opinion, affordability is subjective and it is an issue of what value a customer perceives for the product. I think making vehicles lightweight and building them from the ground up will be important to make them reliable and affordable. Finally, battery prices are coming down but still hover around the $300 per Kwh range at a pack level. Improvements in energy density of cells and longer life cycles will automatically make the total cost of ownership very attractive.”

Supercapacitors for short-duration energy storage and faster charging

As battery-based charging for limited range seems to be a limiting factor for the popularity of electric vehicles, a new technology called supercapacitors are being looked at. They are electric storage devices which can be recharged very quickly and release a large amount of power. The benefits of supercapacitors are balancing energy storage with charge and discharge times, and wide-ranging operating temperatures from roughly -40°F to 150°F. Their disadvantages are self-discharge rate and gradual voltage loss. Nair explains, “The higher energy density of the supercapacitor permits more energy to be stored, but the effect of the larger energy storage on vehicle performance and efficiency is small. The use of supercapacitors would permit the use of energy storage units storing much less energy and having higher efficiency than using lithium batteries. A recent game changer in the supercapacitor segment is the development of a graphene-based supercapacitor that could lead to battery-free electric cars within five years.”

Kashyap states, “Supercapacitors have been around for some time but have not found wide acceptability in EVs. This is primarily because of the low energy density that compromises on range. Fast charging today damages battery life. Supercapacitors don’t have that disadvantage. But there are trade-offs in using any chemistry and a lot of research is ongoing to make an “ideal” product. It is still some time away from commercialisation.”

Clean energy sources for end-to-end zero emissions

Kashyap tells us, “Solar offers the advantage of being a distributed source of energy. We will soon see battery swapping infrastructure and some charging points running on independent solar installations. This means truly zero emission from source to use. Apart from this, increasing solar plants with energy storage can offer reliable 24-hour power supply. This will be a totally renewable and clean power source.”

Vijayan explains, “Electric vehicles will reduce the oil imports and urban pollution; however, it will increase power demand. Penetration of EVs will increase the load on the power distribution grid and disrupt it. Increase in peak demand may cause grid ageing. This is where solar energy and other clean energy sources come into picture. A considerable reduction in grid carbon intensity through transition to solar energy and other clean energy sources is expected.”

Nair adds, “Many big players and start-ups are involved in developing hybrid solar cars. The market for solar-powered cars is projected to be a little over $1 billion by 2021. Solar-powered vehicles that use photovoltaic cells to convert sunlight into electricity save money on fuel, are sustainable and environment-friendly, have no additional costs except battery replacement, do not cause noise pollution or air pollution, and can store energy to a secondary battery (charged during the day) to allow night driving, emitting less greenhouse gases.”

In India, solar-powered cars can be a hit as we have a lot of sunlight. Automobile companies are already capitalising on the popularity and are building solar car kits. Many solar-powered vehicle start-ups and university programmes kicked off in the last several years in the country. However, commercial players are not yet operational in solar-powered vehicle kits in India.

Addressing consumer acceptability, social infrastructure and product innovationsHe adds, “The maintenance/upgrades of Indian roads are mostly done on freeways and not on service roads/city roads. The electric vehicle needs better roads/infrastructure for smooth consumption and good mileage. (This is not new at all as we need better roads for IC vehicles too.) Simple product innovations (through frugal engineering, like Detroit Engineered Products has done) will entice consumers towards EVs (like automatic reverse movement of the vehicle, simple and camera enabled sensors, etc).”

Avisek Bandyopadhyay, Manager Sales & Marketing (Eastern Region) – Ensto Utility Networks, Ensto India Private Limited, shares, “The media has been working on improving consumer awareness. Ensto as well as other EV manufacturers are submitting technical presentations on the benefits of EVs to utilities and other customers like different transport authorities. However, consumers are worried about the lack of charging infrastructure because of which they are apprehensive to buy EVs. The government is also taking the initiative to develop charging infrastructure for EVs. But more effort is required to make a public-private partnership model to develop the infrastructure; only then the people will be ready to buy EVs and the market can be developed.”

Vijayan says, “Lower purchase running cost and good incentive systems will improve the EV market. Improving the safety ratings, ease of parking, special access lanes for EV and tax benefits can improve overall EV market in India. Standardisation, skilled labour and better policymaking is needed to avoid haphazard transition to EV. Product and technology innovation are growing with support of the government and OEMs.”

End-of-life solutions for EV batteries

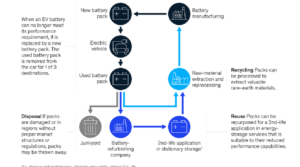

When an EV battery reaches the end of its useful first life, manufacturers have three options: they can dispose of it, recycle the valuable metals, or reuse it. Disposal most frequently occurs if packs are damaged or if they are in regions that lack necessary market structure. In most regions, regulation prevents mass disposal. Recycling can make sense if the battery electrodes contain highly valued metals such as cobalt and nickel because there could be a sufficient gap between the procurement and recycling cost, especially given the predicted tight supply of nickel and potentially cobalt in the 2020s. Nair says, “While having an additional source of battery metals through recycling can be compelling to battery makers looking to secure supply, it will be critical to develop a recycling process that is sufficiently cost-competitive with mining for this path to gain scale; however, new processes that recover more material are not yet fully mature.”

Kashyap explains further, “There are already second-life uses of these cells in energy storage applications. By doing so, you already extend the life for use of cells to 10 years and then worry about recycling. Technology to recover the main elements like lithium already exists but is expensive. As time goes by, this too will become cost-effective.”

However, there are many challenges for the second-life battery such as refurbishing complexity due to lack of standardisation and fragmentation of volume, falling cost of new batteries, nascence of second-life battery standards, and immature regulatory regime. But if Indian EV manufacturers, selective R&D suppliers and recycling providers work together, the life cycle of battery packs from one industry to the other can be increased.

Vijayan shares, “Battery-powered electric vehicles are going to have a significant presence on the road in the next decade. With that, the fate of the many millions of used lithium-ion batteries that power these vehicles will become an urgent environmental issue. It will be important to set targets for reusing and recycling EV batteries, define clear responsibilities for the various parties in the battery value chain, and define chains of ownership for batteries after removal from vehicles. We are seeing government and industry taking the right first steps to make the most of this win-win opportunity.”

Avisek Bandyopadhyay, Manager Sales & Marketing (Eastern Region) – Ensto Utility Networks, Ensto India Private Limited

“More effort is required to make a public-private partnership model to develop the infrastructure; only then the people will be ready to buy EVs and the market can be developed.”

Vishwas Vijayan, Director, Ultra Electric Company (India) Pvt Ltd

“Battery-powered electric vehicles are going to have a significant presence on the road in the next decade.”

Niju Nair, Director – Business Management, ASEAN

“The two key factors which determine the materials used for EVs are range and price.”

Akshay Kashyap, Founder and Managing Director, GreenFuel Energy Solutions

“Improvements in energy density of cells and longer life cycles will automatically make the total cost of ownership very attractive.”

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.