Bailing out the ailing discoms

By EPR Magazine Editorial June 30, 2020 4:47 pm IST

By EPR Magazine Editorial June 30, 2020 4:47 pm IST

COVID-19 situation has just blown out the existing crisis as discoms could not retrieve the electricity bills from the consumers.

The Finance Minister of India has announced Rs. 90,000 crore under Atmanirbhar Bharat to support discoms (distribution companies). It is a welcome step by the union government as many discoms are suffering from cash crunch due to the COVID-19 lockdown. The electricity demand of India has reduced by around 20 percent to 25 percent during the total lockdown. Due to reduction in electricity demand, many of the conventional power plants generation has been drastically reduced and even there is reduction in generation from renewable energy sources when compared to last year. Some of the State governments requested for aid to bail out the ailing discoms.

Discom Losses

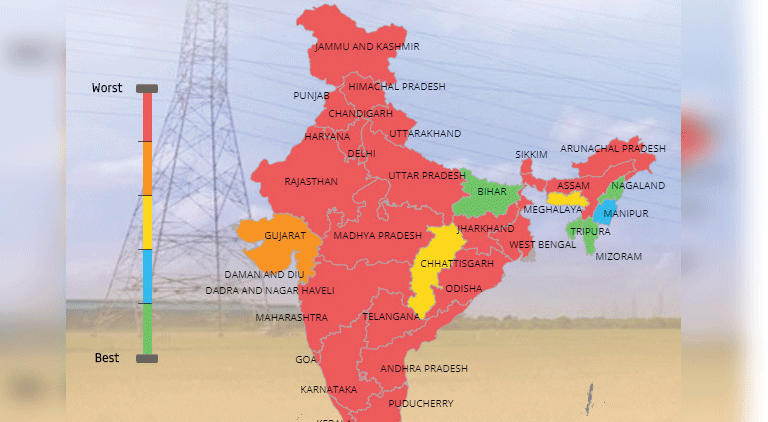

It is not only due to the COVID-19 lockdown the discoms are making losses. Actually, it’s a recurring thing and most of the discoms in the country are making losses all around the year. In financial year 2019, the total losses of discoms was around Rs. 27,000 crore. Moreover, as of April 2020 the total outstanding amount owed by discoms to generators is about Rs. 1,07,853 crore. The severity index of financial status of discoms is presented in Figure 1. Except the states of Bihar, Tripura and Nagaland, the financial status of majority of the discoms is very bad. The states with highest overdue are Rajasthan (Rs. 33,216 crore), Tamil Nadu (Rs. 15,779 crore) and Uttar Pradesh (Rs. 13,408 crore). In the last 12 months, the overdue amount was always around Rs. 90,000 crore. However, the COVID-19 situation has just blown out the existing crisis as discoms could not retrieve the electricity bills from the consumers.

At this juncture, the government liquidity offer was welcome step to bail out the ailing discoms in the short-term. To balance the discoms books in the right direction, the government needs long-term strategies. Even though the UDAY scheme rolled out by the union government had some positive impact on the discoms, still it did not yield expected results in bailing out the discoms. Since, it got expired in March 2020, the government came up with Atal Distribution System Improvement Yojana (ADITYA) for the discoms bailout. For understanding the effectiveness of this new scheme we need to wait and watch. Further, several tranches announced by the finance minister like privatising the UT discoms, new tariff policy are good schemes. However, until it is implemented it is very difficult to predict the impact of it on the Indian power sector.

Reasons for discoms losses?

Each state has its own problems. Some of the reasons are:

Installation of renewable energy

As of April 2020, India has close to 370 GW of installed capacity and its peak demand is only around 180 GW i.e. only less than 50 percent of the installed electricity capacity is under operation most of the times. Rest of the installed capacity are lying idle and with the increase of renewable energy into the electricity system the idle generation capacity is having an increasing trend. Moreover, renewable electricity has must run status and is given preference in generation. The idle generation capacities are actually non-performing assets and it adversely affects the discoms revenues.

Ill-advised subsidies – as populist schemes

This is one of the main reason for poor financial condition. For example, in Tamil Nadu every household is given free 100 units of electricity. From rich to poor everyone electricity consumer is offered this freebie. This is financially unviable for the revenue of the discom. Government needs to target the poor who are mostly in need of these schemes.

So, for the long term success of discoms this Rs 90,000 crore liquidity may not be sufficient. However, it is a blessing in disguise in the short term for discoms functioning. The privatization of discoms in Union Territories can be considered as a precursor to the future privatization of discoms across the country. The days of electricity shortage in the country is long gone. Now the challenge in the electricity sector is to maintain quality, reliability of electricity and making profits. The important point is, electricity is considered as the fourth basic need after food, clothing and shelter. So, it should be considered as a service and not as a commodity. Even though the government declared 100 percent electrification, still certain population is electricity poor. The privatization of it should not hinder their prospects. Until, the electricity poor is eradicated the country should serve electricity and should not sell it as a commodity.

Previously the coal availability was one of the major issues plaguing the discoms. However, through UDAY those issues were addressed. However in the present situation in states with considerable renewable energy capacity, coal power plants are not in operation resulting in low PLF. The new scheme for power distribution should address these issues. Moreover, the new tariff policy is expected to aid the discoms. Until these issues are addressed, if discoms makes profit it may be considered as an aberration.

Authored By:

Dr. Balasubramanian S. Indian Institute of Science, Bangalore

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.