Momentum of Smart Meter Adoption in India for widespread benefits

By EPR Magazine Editorial September 5, 2023 11:46 am IST

By EPR Magazine Editorial September 5, 2023 11:46 am IST

There is a need for utility transformation and platform solutions that cater to specific smart grid needs like energy trading and exchange, smart meter standard interoperability, etc.

Everyone, including industry players and energy sector analysts, is gung-ho about Smart Meters for being the game changer in transforming India’s power sector and its cascading effect on India’s economy. Smart meters have emerged as a crucial component of modernising India’s energy sector, providing numerous benefits such as accurate billing, improved load management, and enhanced energy distribution. However, the adoption of these meters is heavily influenced by their pricing strategies, which affect their competitiveness, integration with smart grid infrastructure, and utilisation of advanced technologies to address challenges like energy theft and interoperability.

Pricing strategies

The Indian smart meter market is set to grow at a 7.3 percent CAGR by 2022, expanding further by 11.1 percent by 2033. However, adoption may be hindered due to higher initial costs than traditional meters. Pricing directly affects utility companies’ adoption. DISCOMs’ weak financial health, regulatory hurdles, ROI uncertainty, and cost recovery are major barriers. Overcoming these challenges is vital for accelerated adoption. As technology spreads and costs drop, adoption is expected to rise. Advancements and scaled manufacturing contribute, while component costs (communication modules, relays, and sensors) also impact final prices. Addressing these barriers is crucial for the government, utilities, and manufacturers to boost adoption.

Balancing cost competencies

The pricing strategies meter manufacturers adopt directly impact their competitiveness in the Indian market. Striking the right balance between affordability and advanced features can determine a manufacturer’s success. Competitive pricing can lead to increased market share and adoption, while overly high prices deter utilities and consumers from transitioning to smart meters. Those with an end-to-end product value chain and who can produce smart meters at a lower cost are better positioned to offer competitive prices, thus gaining an edge in the market. Moreover, innovative and cost-efficient manufacturing techniques can enable manufacturers to stay ahead in this competitive landscape. Proprietary technologies and varying price points among smart meter manufacturers could create compatibility problems and market fragmentation.

A data-driven approach for power utilities

To accurately forecast demand and efficiently manage their supply chain, energy meter manufacturers in India employ various methodologies, including historical data analysis, time series analysis, ARIMA models, conjoint analysis, the Delphi method, market trend assessment, government policies and regulations, market trends, and projections of future energy needs to predict demand patterns and collaborate with utilities. A data-driven approach enables them to anticipate demand patterns and adjust production accordingly.

Supply chain management is critical to ensuring the timely delivery of smart meters. Supply chain management involves robust relationships with suppliers (e.g., managing semiconductor chip scarcity), flexible production processes (running bench 24*7 or 8 hours a day), inventory management, multiple manufacturing facilities, efficient logistics, safety stocks, and buffer inventory. Manufacturers must maintain agile supply chains capable of responding to fluctuating demand. Agile manufacturing practices, such as flexible production lines and rapid prototyping, are also utilised.

Communication infrastructure in smart grids

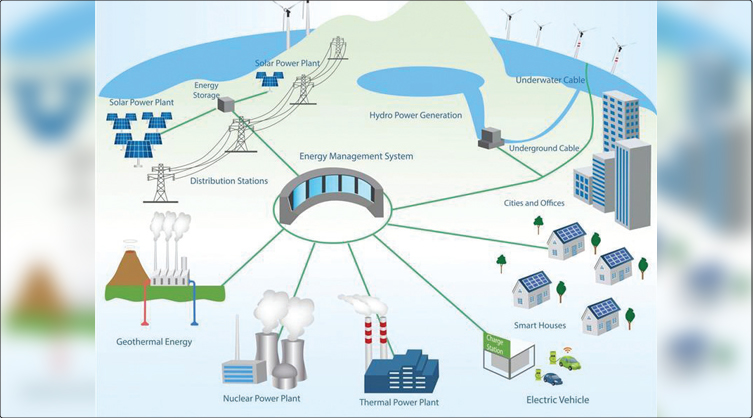

Indian energy meters are being integrated into the evolving smart grid infrastructure. Smart meters facilitate two-way communication between consumers and utilities, enabling real-time data exchange. This integration enhances grid reliability and enables demand-response mechanisms, load management, and outage response. As technology and policies evolve, it is essential to keep abreast of recent sources and updates on how Indian energy meters integrate with the smart grid infrastructure.

Smart meters generate a huge chunk of data that utilities, as custodians, can leverage for optimisation. Advanced data analytics provide insights into energy consumption patterns, peak demand periods, areas of energy waste, and voltage fluctuations. These insights enable utilities to optimise energy distribution, predict load requirements, and enhance consumer billing accuracy.

Demand forecast management

Analysing consumption patterns enables forecasting future demands and personalised energy efficiency recommendations. Accurate billing is ensured through precise consumption data, reducing disputes. Data analytics also helps detect energy losses, identify infrastructure issues, and improve grid maintenance and overall efficiency. Additionally, smart meter data improves asset management, identifies fraud, and fosters the development of new energy products and services, adding value to the collected data. There is a need for utility transformation and platform solutions that cater to specific smart grid needs like energy trading and exchange, smart meter standard interoperability, etc.

In California, Pacific Gas & Electric is using smart meter data to implement a demand response program called Peak Time Rebate. This program encourages consumers to reduce their energy usage during peak demand periods in exchange for a financial incentive. Likewise, in New York, Con Edison is using smart meter data to develop a new energy product called Smart Energy Saver. This product allows consumers to track their energy usage in real time and receive personalized recommendations on how to save energy. In Australia, the Australian Energy Market Operator (AEMO) is using smart meter data to develop a new grid management system called the National Smart Grid Platform. This system will use smart meter data to optimize the distribution of energy across the Australian grid.

Addressing energy theft, remote monitoring, and smart device interoperability, advanced technologies have emerged as pivotal solutions. They are crucial in tackling these challenges within the smart grid landscape. Smart meters, featuring tamper detection and real-time monitoring, effectively counter energy theft. Integrating IoT devices and home automation systems fosters seamless communication between smart devices, empowering users to manage energy consumption. Interoperability is achieved via standards like Zigbee, Z-Wave, and Bluetooth, enabling smooth interaction among diverse manufacturers’ devices. AI and IoT integration optimise energy distribution, bolstered by demand-side management. Machine learning identifies theft patterns; blockchain ensures secure transactions, and 5G facilitates real-time data transmission. These advancements elevate grid efficiency and mitigate energy theft risks.

The price of smart meters in India plays a pivotal role in shaping their adoption and market penetration. Still, with innovative strategies and technological advancements, the market is witnessing a gradual increase in adoption rates. Manufacturers must consider various factors, including technology costs, economies of scale, regulatory influences, and competition, to develop effective pricing strategies. The integration of smart meters with the country’s evolving smart grid infrastructure offers immense potential for optimizing energy distribution and load management. With advanced data analytics, utilities can extract valuable insights from smart meters to enhance efficiency and billing accuracy. Furthermore, the integration of technologies like energy theft prevention and remote monitoring underscores the transformative potential of smart meters in modernizing India’s energy sector.

(This article includes contributions from Vinit Mishra, Partner at Ernst & Young LLP; Amit Sharmaa, Director at Ernst & Young LLP; Ravi Ravi Singh, Smart Meter Lead at Ernst & Young LLP; Chandrashekhar Saraswat at Ernst & Young LLP; and Moloy Das at Ernst & Young LLP.)

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.