Industry seeks encouragement domestic manufacturing, and sustainable wires and cables

By EPR Magazine Editorial February 24, 2022 4:27 pm IST

By EPR Magazine Editorial February 24, 2022 4:27 pm IST

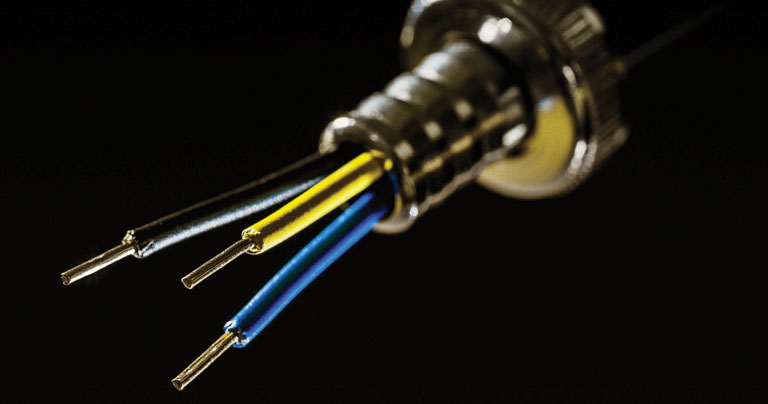

With the advent of governments push for smart cities and instilling digital technologies in almost every industry, the cables and wires players are hopeful of meeting the criterion to elevate the adoption of quality installations of fire resistant wires and cables across.

The India wires and cables market would expand as a result of the government’s increasing investment in infrastructure development. The expansion of smart cities in the country, as well as the increased usage of electronic gadgets in the home, would raise demand for wires and cables in the Indian market.

Scenario for investment in the cables and wires sector

The recent Union Budget 2022 has focused on our nation’s growth with major policy announcements in the areas of energy, connectivity, and capacity building that will further contribute to the revival of the economy. According to Hemant Gadhave, Vice President, Business Unit Head-Wires and Cable Business, Panasonic Life Solutions India, “One of the biggest drivers for the wire and cable industry is the real estate and infrastructure sectors. From the budget, we expect to see encouraging localisation of electronic components from the budget to increase independence in local manufacturing. Moreover, exports should be encouraged to a larger extent as India is slowly gaining a strong foothold in the export market, particularly in the electrical and wire and cable industries.

According to Manjit Singh, Executive Director – Cables, KEC International Ltd., “Infrastructure impetus for data centres and energy storage systems are also welcome moves for the sector. Additionally, the allocation of 19,500 crore for PLI for the manufacture of high-efficiency solar modules for the ambitious goal of 280 GW of installed solar capacity by 2030 will attract new avenues for wires and cables in large proportions.

According to Naman Singhal, Director, Prime Cables, “The Bharatnet project through PPP (PublicPrivate Partnership) in 2022-23, will have most of the villages and remote areas well-connected. This is expected to be completed by 2025. Hence, there will be an emphasis on the more efficient use of optical fiber.”

Catering to the continuous power demand in changing energy dynamics

“Despite the global pandemic crisis, the performance for this financial year in terms of growth value has been positive in this sector. There has been a significant rise in demand for electricity in India, especially with the increase in urbanisation, says Hemant.

Following the ‘Saubhagya’ scheme introduced by the government for rural electrification, we are moving towards a more connected nation. This is a positive growth driver for the industry as a whole. “As an industry leader in the wiring devices and wires segment of India, Panasonic has opportunities to bring effective change in the rural areas. This will further impact demand and open doors to new opportunities and create new markets.

Whereas, Naman explains that the increase in the price of raw materials, like price increases in copper, silver, and other components used in making wires, directly impacts the cost of the cables and wires.

“The industry is already working to meet the demand for a safe and efficient power supply by converting overhead distribution lines to underground cable networks as per demand,” Manjit highlights. The industry is also raising awareness of the usage of fire retardant and fire resistance cables. KEC also offers a range of cable products catering to these segments, viz. FR, FRLS, and Fire Survival cables.

Import restrictions and raw material prices are impacting the growth

In the wires and cable business, the major cost involved is the raw material cost. Any slight increase in the price of raw materials affects the margins of the business. Here, explaining the fluctuating cost of copper and PVC, which almost doubled in the previous financial year, Hemant says, “The increasing price of raw materials, including copper and PVC, is becoming a major issue for the wire and cable industry.”Agreeing to the same, Manjit adds that the erratic volatility in prices of metals such as copper and aluminium is causing uncertainty in the pricing of cable products. Recent rises in crude oil prices have led to an enormous rise in petroleum products such as polyethylene resin and PVC, which in turn has pushed up the XLPE compound price by over 40 percent in the last year. In terms of price increases, fibre is no exception. Whereas, Naman explains that the increase in the price of raw materials, like price increases in copper, silver, and other components used in making wires, directly impacts the cost of the cables and wires.

Addressing the fire safety concerns

Studies have shown that casualties in a short-circuit induced fire are not because of the fire but of the toxic fumes emanating during the burning of the insulation material. Manufacturers from the unorganised sector use inferior materials. These inferior materials pose a hazard to human lives in the event of a fire accident.

The Indian consumers aren’t really aware products such as wires. Hemant takes this opportunity to highlight products and their certification standards, saying, “We at PLSIND design all our products with the top priority of user safety and quality. Our wires also have the product safety “S-Mark” certification from STQC, and at present, we are the only manufacturer with a safety mark for wires. Our products conform to the specified requirements of appropriate safety standards published by the International Electro-technical Commission (IEC). The presence of the SAFETY Mark also indicates that internal safeguards have been incorporated for protection against fire and electrical hazards.

Manjit terms this as a critical concern for the safety of both the product and human life. He believes that awareness of the importance of fire retardant cables and fire resistant cables is slowly growing in India. Striking a balance between price and quality is one of the challenges that cable and wire companies in India have been facing for quite some time.

With such wires, there is always a threat of short-circuit or fire. One of the primary reasons people are switching to cheaper cables and wires is a lack of awareness about the aftermath of the same. “Generating awards about the long term impact of using low-grade cables and wires can be helpful in this,” adds Naman.

Future of green and sustainable cables and wires

We need additional awareness for the acceptance and usage of green cables in India. The insulation used in green wires is made from materials that do not cause environmental pollution, have better fire resistance, have low toxicity, are recyclable and free from any carcinogenic substances. The insulation also provides high-temperature stability.

Sustainable wires are widely accepted by customers who care for the safety of their house occupants and others around them. However, awareness of green cables is still low in our country. We provide all products with RoHS compliance. The government of India is working on around eight environmentally friendly and sustainable schemes. Hence, several government departments find eco-friendly and sustainable wires a perfect match for their needs.

Take away

The forward-thinking, CapEx-led Budget 2022, with a 35 percent increase in outlay, is expected to boost the wires and cables industry. A lot of impetus will come from PM Gatishakti and its seven engines of growth, viz., roads, railways, airports, ports, mass transport, waterways and logistics infrastructure.

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.