Discom debt to hit all-time high: CRISIL

By EPR Magazine Editorial June 30, 2020 4:35 pm IST

By EPR Magazine Editorial June 30, 2020 4:35 pm IST

Liquidity package offers a breather, but structural reforms have become critical to sustainability

The Centre’s recent Rs 90,000 crore liquidity line will help state power distribution companies (discoms) settle a significant portion of their overdue bills to generating companies. However, with power demand weak and cash losses high amid the Covid-19 pandemic, discoms would end up owing lenders a staggering Rs 4.5 lakh crore by the end of this fiscal, or 30 percent more than last fiscal, said a report published by CRISIL Ratings.

Such a material increase in debt would deteriorate the credit profiles of discoms and make structural reforms critical to their sustainability, a study of 34 state discoms (from 15 states), which account for over 80 percent of India’s power demand, shows.

Today, only one in five discoms is capable of servicing debt through own cash flows and budgeted subsidies. The scenario would worsen this fiscal because of weak demand for power, which comes on the back of an already low base of last fiscal, rising costs, and losses caused by the pandemic-led lockdown.

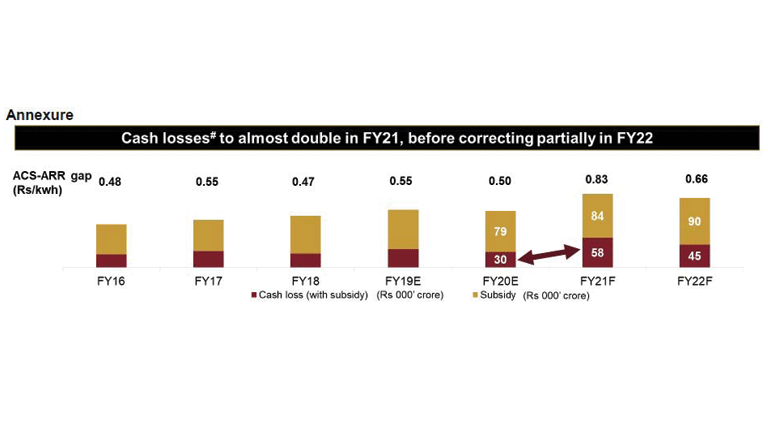

Manish Gupta, Senior Director, CRISIL Ratings, says, “Higher costs and constrained cash inflows amid declining demand mean the per-unit operating gap of discoms will widen to 83 paise per unit by the end of this fiscal. In other words, cash losses this fiscal may almost double to Rs 58,000 crore over last fiscal, despite higher subsidy support from state governments.”

Power demand fell a fifth on-year in April and May combined. According to the report from CRISIL, while there are signs of a gradual recovery, all-India power demand could be lower by 2 percent, or around 31 billion units, this fiscal because industrial and commercial consumers – who pay 50-100 percent more and cross-subsidise domestic and agricultural consumers – have been the worst hit by the lockdown.

Moreover, the ratings agency observed, collections will be under pressure as discoms have allowed consumers across categories to defer payments and not all of the dues may be recouped with the economy staring at a recession. Net-net, this would mean lower cash inflows this fiscal.

Tilting the demand mix towards domestic and agriculture segments will hurt as well. These segments have relatively higher transmission and distribution losses because of lower levels of metering and higher power theft. In addition, net fixed payments for power purchases, and administrative and interest expenses will raise per unit cost in times of declining demand.

The pandemic-driven losses would further scar the indebted balance sheets of discoms. While the additional debt line of Rs 90,000 crore from the Power Finance Corporation and REC Ltd can reduce overdues to gencos, this would be a temporary stitch at best. The higher cash losses could lead to payables re-inflating sans incremental funding or state support.

“Next fiscal, as demand improves and distribution losses reduce, the operating gap could narrow to 66 paise. We have baked in a tariff hike of 2 percent – the average of the past three fiscals – into this calculus. However, to fully recover higher costs due to incremental borrowings, the tariff hike needs to be 300 bps more, or 5 percent,” said Naveen Vaidyanathan, Associate Director, CRISIL Ratings.

Some of the Centre’s recent initiatives such as reduction of discom receivables from state entities as part of loan package, the move towards cost-reflective tariffs, and privatisation are steps in the right direction. However, all these would require a clean-up of legacy debt, removal of cross-subsidies, and more importantly, enhanced commercial orientation of discoms. Those would be the key monitorables in the next reforms package expected.

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.