Advanced metering and data management are key for an energy transition

By EPR Magazine Editorial January 4, 2023 6:19 pm IST

By EPR Magazine Editorial January 4, 2023 6:19 pm IST

With the increased installation of smart meters for residential applications, the demand for additional energy supply via fossil fuel plants during peak times is decreasing, while consumers’ desire for peak-time energy savings is increasing.

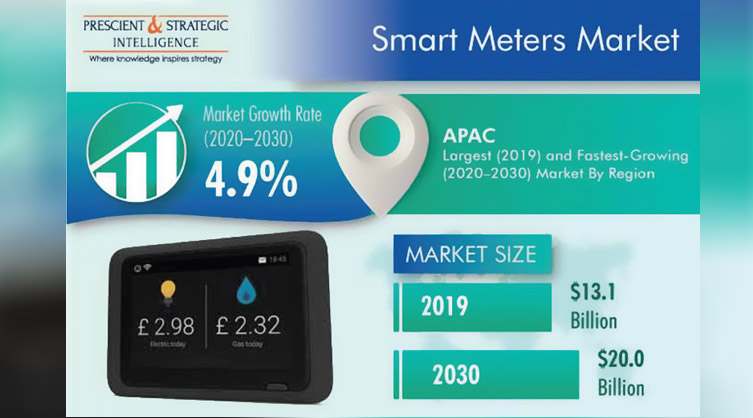

The global smart meters market is expected to reach $20.0 billion by 2030 at a CAGR of 4.9 percent. The increasing focus on smart grids, which boosts the adoption of smart meters, is among the major driving factors for the smart meters industry. Additionally, the growing consumer awareness of energy conservation and governments’ focus on replacing traditional meters with smart ones are generating a high demand for smart meters globally.

The disruptions caused by COVID have had a significant impact on the smart metres market, as power utilities initially encountered difficulties in installing smart metres in the residential and commercial segments. Moreover, to balance the slow economic growth, the government is now utilising funds allocated for infrastructure modernisation and offering subsidies and monetary help to citizens. So, there are possibilities that countries will either miss or extend their targets for nationwide smart meter deployment, which, in turn, would hamper the market’s growth shortly.

Software category to record faster growth in future

According to an analytical report published in “PS Market Research,” based on the offering, the software category is projected to record faster growth during the forecast period. This can be attributed to the rising demand for software for identifying anomalies in utility consumption patterns and ensuring accurate billing. Head-end software (HES) and meter data management (MDM) are the two major types of software used in smart meters. HES is primarily used for data collection, while MDM is a storage platform for smart meters. The software also helps better manage the operations of smart meters deployed by utilities, thereby driving the smart meters market’s growth in the future.

Adoption of electric meters

The higher adoption of electric meters as compared to water and gas meters is the primary reason for the dominating share of this category in the smart meters market. This is attributed to the fact that governments and other regulatory bodies around the globe are encouraging the installation of smart electricity meters. The installation of such devices is also increasing due to their several benefits, such as energy savings, peak consumption knowledge, and fraud detection.

Growing market prospects for Advanced Metering Infrastructure (AMI)

Based on technology, the AMI category is expected to continue witnessing faster growth during the forecast period in the smart meters market. AMI is fast replacing automatic meter reading (AMR), as it is an integrated system of smart meters equipped with a communication network and data management systems that enable two-way communication between utilities and customers. It facilitates cost savings by remotely reading meters and connecting/disconnecting services, generates more accurate bills faster, and enables utilities to provide customers with digital access to their usage information.

Smart metering applications are becoming prominent in the residential segment.Since the historical period, the residential category has held the largest share in the application segment for smart meters. This will continue to trend like this in the near future, as the residential segment is one of the primary consumers of electric meters and smart meters.

With the increasing installation of smart meters for residential applications, the demand for extra energy supply through fossil fuel plants during peak times is reducing, and consumers’ inclination for peak-time energy savings is increasing. This is further helping reduce carbon dioxide emissions globally, thereby fuelling the smart meters market growth.

Smart meters are essential for accurate billing

The adoption of smart and efficient monitoring and control devices is facilitating improved billing accuracy in the service sector, including in private offices, data centres, and government buildings. For instance, a report from the Energy Efficiency Services Limited (EESL), an energy service company of the Government of India, revealed that states with smart meters demonstrated an average rise of nearly 25% in billing compared to those with conventional meters.

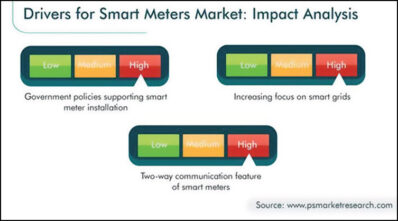

Government policies supporting smart meter installation

Governments in several countries are supporting the installation of smart meters, which, in turn, is driving the growth of the market globally. As part of clean energy initiatives, governments of various countries have rolled out legislation that mandates the adoption of smart meters. For instance, in February 2020, under the Government of India’s Smart Meter National Programme, state-owned company EESL announced the completion of the installation of one million (10 lakh) smart meters across India. Further, EESL has set a target of installing 250 million (25 crores) smart meters in the country over the next few years.

The two-way communication feature of smart meters is also contributing to market growth

Smart meters support a bi-directional flow of information. These meters are deployed at the end user’s premises, to collect information on the electricity usage by all appliances at regular intervals, using a local area network (LAN). Further, the data from individual smart meters is collected by local data aggregators using neighbourhood area networks (NANs) and then transmitted to the utility centre using a wide area network (WAN).

Similarly, the utility centre can send commands, signals, or information to the smart meter at the end user’s premises, when required. Moreover, major appliances at home, such as washing machines, can be automated with the help of smart meters. This allows end users to benefit from various advantages, including time-of-use tariffs, thus driving the smart meters market growth.

Mergers and Acquisitions and Product Launches Are Important Strategic Developments

The smart meters market is competitive in nature, with Landis+Gyr holding the major share in 2019. Furthermore, companies including Siemens AG, Itron Inc., Sagemcom, and Aclara Technologies LLC are likely to increase their foothold by focusing on product development, coupled with increasing their investments in research & development (R&D) activities. Mergers and acquisitions are also important strategies adopted by players operating in the smart meters market.

For instance, in May 2019, Schneider Electric acquired a stake in AutoGrid, a provider of management software solutions for the energy industry. The investment makes Schneider Electric a major shareholder in the company and establishes a co-innovation partnership focused on driving new AI and machine learning solutions for utilities and commercial and industrial companies.

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.