Indian DG market is projected to grow to USD 1.74 billion by 2030

By EPR Magazine Editorial February 12, 2025 2:20 pm IST

By EPR Magazine Editorial February 12, 2025 2:20 pm IST

According to Mordor Intelligence, the Indian diesel generator market will be valued at USD 1.34 billion by 2025 and is projected to grow at an estimated compound annual growth rate (CAGR) of 5.4 percent from 2025 to 2030.

The Indian diesel generator market is experiencing a dynamic period of growth and transformation. Valued at USD 1.34 billion in 2025 and projected to reach USD 1.74 billion by 2030, with a CAGR of 5.4 percent, according to Mordor Intelligence. The market is driven by rapid urbanisation, frequent power outages and substantial industrial expansion. These factors necessitate reliable backup power solutions, particularly in critical sectors like manufacturing, infrastructure and commercial operations. India’s ambitious infrastructure projects, such as the Atal Tunnel and Chenab Bridge, along with the growth of manufacturing hubs fueled by initiatives like ‘Make in India,’ further propel the demand for diesel generators.

However, this growth is intertwined with the increasing adoption of cleaner energy sources and growing environmental concerns. The push for energy security and the availability of viable alternatives like natural gas, biodiesel, and solar energy present significant challenges to the traditional diesel generator market. Stringent regulations aimed at curbing air and noise pollution, exemplified by bans on diesel generators in regions like Delhi NCR, further complicate the landscape. This evolving scenario necessitates innovation and adaptation within the market, with manufacturers exploring hybrid systems, smart technologies, and cleaner fuel options to remain competitive.

Key market trends

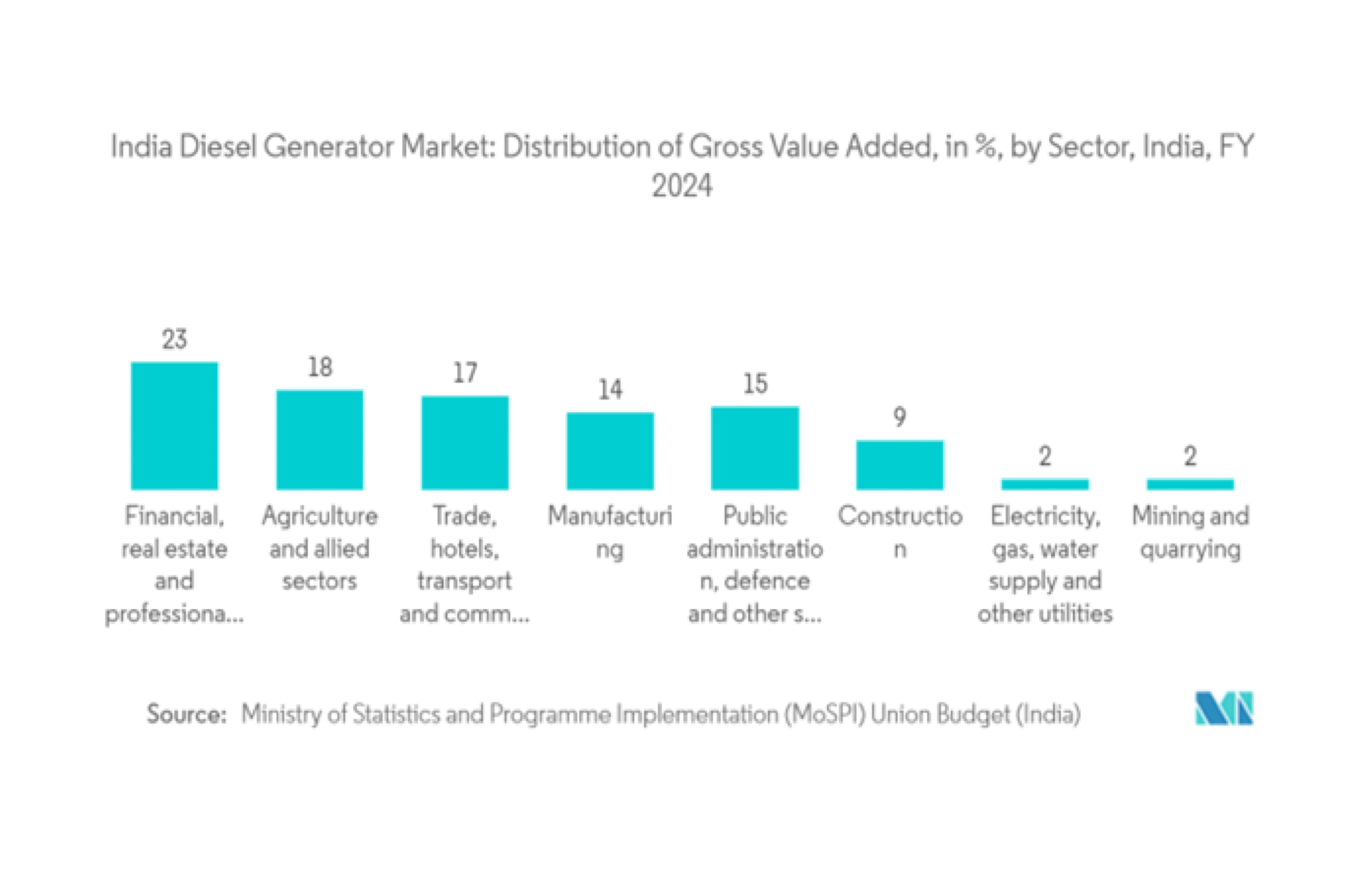

The commercial segment is poised to dominate the diesel generator market in India. Industrial operations, particularly in sectors such as crude oil, refining, mining, automotive, chemicals, and pharmaceuticals, heavily rely on diesel generators to ensure uninterrupted power supply during outages or in regions with limited grid access. These industries account for the largest share of energy consumption, driving the demand for diesel generators.

India’s infrastructure development initiatives further bolster this demand. For instance, in March 2024, the Government of India announced ambitious infrastructure projects, including the Atal Tunnel (the world’s longest highway tunnel) and the Chenab Bridge (the world’s highest railway bridge). These projects, located in remote areas, necessitate diesel generators to power construction activities.

Manufacturing sectors, particularly in Gujarat, Maharashtra, and Tamil Nadu, are witnessing robust growth due to initiatives like ‘Make in India’ and Production Linked Incentive (PLI) schemes. These regions, which have seen significant investments in industries such as automobiles, textiles, and electronics, require reliable power solutions to avoid costly production disruptions. According to the India Brand Equity Foundation (IBEF), India’s manufacturing sector is expected to reach USD 1 trillion by 2025-2026, further fueling the demand for diesel generators.

Large-scale infrastructure projects, including metro rail expansion and road construction, drive diesel generator adoption. For example, in September 2024, the government announced an investment of INR 3 trillion in metro rail projects to enhance urban mobility and reduce congestion. Diesel generators are crucial in these projects, providing power during construction and serving as backup sources.

Facing challenges

The growing emphasis on renewable energy and cleaner fuels presents a challenge for the diesel generator market in India. Rising environmental concerns and the push for energy security have led to a shift toward natural gas, biodiesel, ethanol, and solar energy. Technological advancements have made these alternatives increasingly viable, threatening traditional diesel generators.

Diesel generators are often criticised for their high air and noise pollution levels. Gas generators, which are quieter and emit fewer pollutants, are becoming a preferred choice for many industries. Additionally, regulatory measures are being implemented to curb diesel generator usage. In September 2023, the Commission for Air Quality Management (CAQM) banned using large diesel generator sets in the Delhi NCR region, except for essential services like healthcare. Similarly, the Goa State Pollution Control Board (GSPCB) has prohibited diesel generator integration to reduce pollution levels.

Industrial giants are also transitioning to cleaner alternatives. For instance, in March 2024, Samsung India replaced diesel generators with natural gas-powered generators at its Noida plant, highlighting the shift toward sustainable practices. The transition reduces emissions and offers cost savings, further incentivising industries to adopt cleaner solutions.

Indian manufacturers, such as Greaves Engineering, are responding to this trend by developing cleaner alternatives. In July 2024, Greaves launched a range of ethanol—and biodiesel-compatible gensets, offering capacities from 5 kVA to 500 kVA. Other companies, like Jakson Group and Mahindra Powerol, are also investing in hybrid systems and renewable energy technologies.Innovations and opportunities

Despite the challenges, the diesel generator market in India is evolving with technological advancements and innovative solutions. Hybrid energy systems and smart diesel generators equipped with digital tools are emerging as game-changers. These systems combine diesel generators with renewable energy sources, such as solar and wind, to reduce fuel consumption and emissions.

Solar generators integrated with battery storage are also gaining traction. For example, in May 2026, EcoFlow introduced solar generators in the Indian market, offering a capacity of approximately 2048 watt-hours. These generators are designed to provide emergency power for up to two days, presenting a robust alternative to diesel generators.

The government’s focus on renewable energy development further underscores this transition. As of February 2024, India’s private sector had the largest installed renewable energy capacity, totalling around 223,000 MW. Small- and large-scale renewable projects generate clean energy and create employment opportunities, particularly in rural areas.

Future outlook

The Indian diesel generator market is poised for steady growth, driven by industrial expansion, infrastructure development and the need for reliable power solutions. While adopting alternative energy sources poses a challenge, innovations in hybrid systems and smart technologies present significant opportunities.

Manufacturers and suppliers must adapt to changing market dynamics by investing in cleaner, more efficient technologies. As the industrial and infrastructure sectors continue to grow, diesel generators will remain a critical component of India’s power landscape, providing a reliable solution for backup and emergency power needs.

In conclusion, despite the growing adoption of renewable energy and stricter environmental regulations, the Indian diesel generator market is expected to maintain steady growth, driven by continued industrial expansion and infrastructure development. While challenges persist, innovations in hybrid systems, smart technologies, and alternative fuels offer significant opportunities. Manufacturers must adapt to these evolving market dynamics by investing in cleaner and more efficient solutions. Diesel generators will remain a crucial component of India’s power landscape, providing essential backup and emergency power, particularly in remote areas and during critical operations, ensuring reliable power access alongside the transition to more sustainable energy sources.

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.