Investing in energy storage, transmission and Centre-State coordination critical to ensure reliable power supply: CEEW

By EPR Magazine Editorial March 12, 2025 6:11 pm IST

By EPR Magazine Editorial March 12, 2025 6:11 pm IST

If power demand follows CEA projections current and planned clean energy capacities will suffice, but if demand grows faster a high renewable energy pathway will be the most cost-effective despite flexibility challenges, the study says.

India needs to scale up to 600 GW of non-fossil-fuel capacity by 2030 to meet its growing electricity demand reliably and affordably, according to a new, independent Council on Energy, Environment and Water (CEEW) study launched at the National Dialogue on Powering India’s Future today in Delhi. The study, How Can India Meet Its Rising Power Demand? Pathways to 2030, is the first-of-its-kind to model India’s power system despatch for every 15 minutes in 2030. It found that if India’s electricity demand grows as per the Central Electricity Authority’s (CEA) projections, India’s existing, under-construction, and planned generation capacities would be adequate to meet power needs in 2030. The CEEW study launch was attended by Dr Suresh Prabhu, Trustee, CEEW and Former Cabinet Minister; Shripad Yesso Naik, Hon’ble Minister of State for Power and New and Renewable Energy; Ghanshyam Prasad, Chairperson, Central Electricity Authority; officials from distribution companies and the private sector.

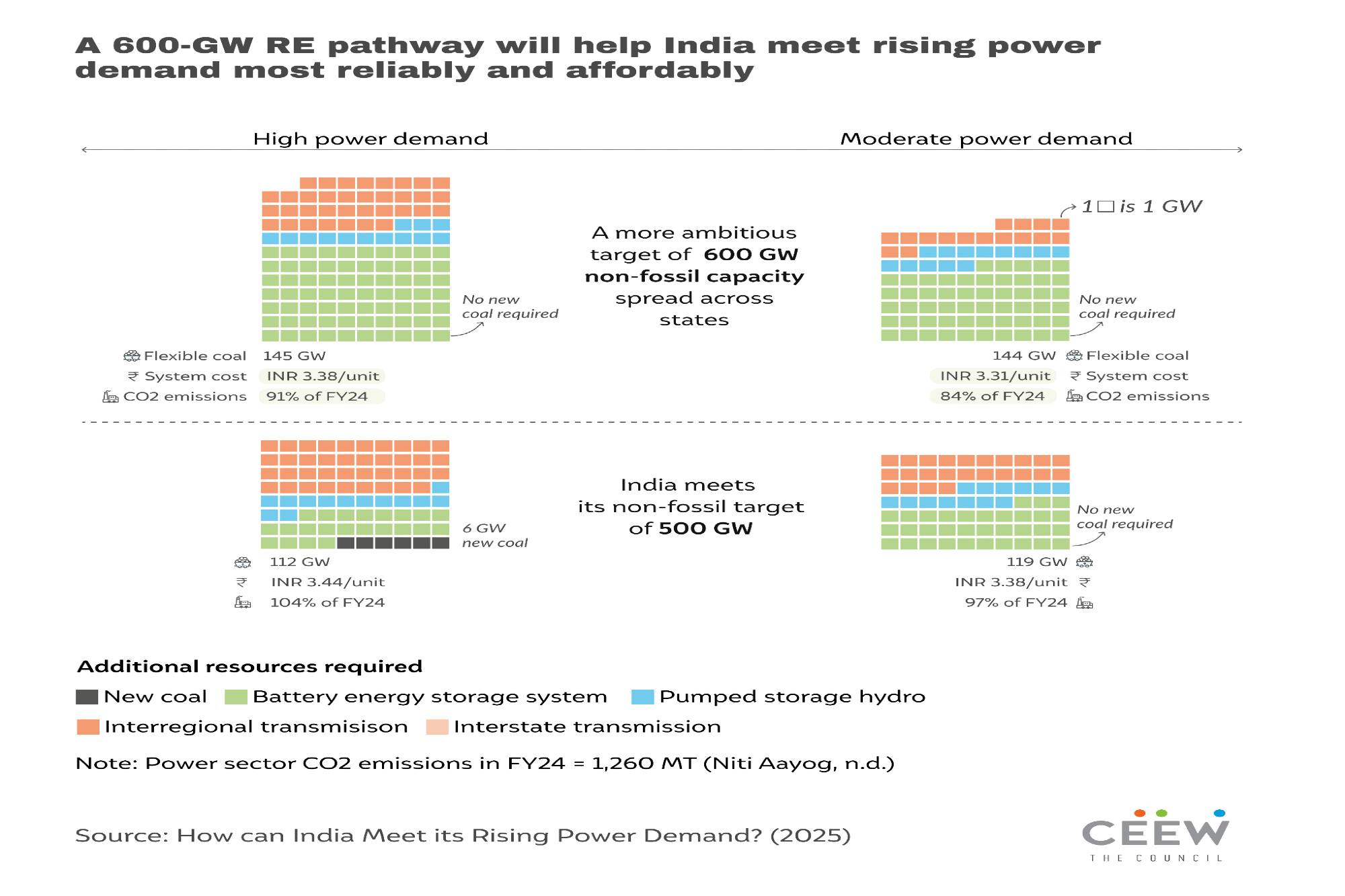

However, if power demand were to continue to outpace current projections due to a warming planet or strong economic growth over the coming five years, the CEEW study finds that a high renewable energy (RE) pathway of 600 GW of non-fossil capacity by 2030 offers the most viable solution, mainly due to cheaper RE resources. This would include 377 GW of solar, 148 GW of wind, 62 GW of hydro, and 20 GW of nuclear energy. This research comes in the wake of the country’s power demand reaching a record 238 GW in February 2025 with peak demand expected to touch 260 GW in the summer months, surpassing projections due to unusually warm weather.

Shripad Yesso Naik, Minister of State for Power and New and Renewable Energy, said, “We have set ambitious targets to increase the capacity of non-fossil fuels and reach net zero by 2070. These goals are essential for a Viksit Bharat. Our clean energy journey has been remarkable — from 76 GW in 2014 to 220 GW in 2025 of non-fossil capacity. CEEW’s report, released today, is very timely in highlighting the pathways on this journey until 2030. Renewable energy is the foundation of our future energy security. Every state must leverage its unique RE potential. A clean grid must serve consumers efficiently, while ensuring financial viability for discoms.”

Suresh Prabhu, Former Union Cabinet Minister, Government of India, and Trustee, CEEW, said, “India’s energy transition must match its economic ambitions. We need to plan for a high renewable share today to send the right market signals for tomorrow. Scaling up to 600 GW of non-fossil capacity by 2030 requires a future-ready policy and regulatory framework. While the government is taking bold steps, stronger policies, industry collaboration, and research-driven, distributed solutions are essential to address challenges in grid management, deployment, and financing. This CEEW study provides good guidance to the sector.”

Ghanshyam Prasad, Chairperson, Central Electricity Authority, said, “Our policies must continually address the affordability of power, which drives industry and growth. Annual scientific studies are needed to assess states’ resources and requirements to tackle offtake issues. Further, delivering RE targets must be a joint effort between the Centre and states. We need to take into account the comfort of each state in buying power depending on demand patterns as well. Finally, the share of electricity traded in power markets must grow.”The CEEW report models multiple scenarios for India’s power sector in 2030, including a baseline scenario that assumes electricity demand grows as per CEA projections and that India meets its 500 GW non-fossil fuel target. However, if India does not meet its clean energy targets, and reaches only 400 GW of non-fossil capacity by 2030, power shortages could emerge, necessitating 10-16 GW of new coal capacity, and significant enhancements in the transmission network to ensure grid stability. Therefore, the CEEW report identifies current clean energy challenges—such as land procurement, timely grid connectivity and balancing, supply chain constraints and un-tied capacity under central auctions—that need proactive action to tap into the massive market potential and project implementation on the ground.

The acceleration in ambition is important. Deploying 600 GW of clean energy across more states could reduce generation costs by 6-18 paise per unit, eliminate the need for new coal plants, save between INR 13,000 crore and INR 42,400 crore in power procurement costs, and create 53,000 to 1,00,000 additional jobs—all while cutting carbon emissions by 9-16 per cent, compared to FY24. Achieving 600 GW-non-fossil capacity would require significant investments in flexible resources such as battery storage (70 GW of four-hour battery energy storage systems), pumped storage hydro (13 GW), and retrofitting 140 GW of coal capacity to manage grid stability. The rapidly declining cost of battery storage favours a high RE pathway. For instance, in the last two years alone, tariffs for stand-alone battery storage have dropped by 65 per cent, without any subsidy support. Another positive step in scaling RE integration is the Indian government’s recent mandate for all future solar project tenders to include energy storage systems with at least two hours of capacity to improve grid stability.

Dr Arunabha Ghosh, Founder and CEO, CEEW, said, “India has rapidly expanded its power sector—becoming the world’s third-largest producer of electricity, with 98 per cent of its households electrified by 2023, and solar and wind capacity quintupling since 2013. The challenge is to now decarbonise while ensuring reliable and affordable power for a fast-growing economy. Achieving 600 GW of non-fossil capacity by 2030 is not just about meeting demand—it’s about energy security, cleaner air, and ensuring that the aspirations of a fast-growing India are met with the right market signals and regulation. This needs continuous innovation in policy, correct energy pricing, smarter transmission grid planning and digitisation, and decisive centre-state coordination.”

Addressing current challenges would accelerate timely RE deployment. CEEW recommends a set of policy measures to accelerate India’s clean power transition and set ambitious targets that send a strong market signal. The Ministry of Power (MoP) must set a clear target of 600 GW of non-fossil capacity by 2030 and integrate it into the National Electricity Policy. It must promote a technologically and geographically diverse RE portfolio. Further, the MoP, in collaboration with the Ministry of New and Renewable Energy (MNRE) and other agencies, must identify innovative models to utilise existing land and transmission infrastructure by co-locating wind and storage with solar projects, implement a Uniform RE Tariff (URET) to tackle concerns about falling clean energy prices, innovate bidding and contract designs, and unlock de-risked merchant capacity for RE sales.

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.