Urbanisation and infrastructural demands are driving the market for Cables and Wires

By EPR Magazine Editorial November 18, 2021 6:40 pm IST

By EPR Magazine Editorial November 18, 2021 6:40 pm IST

Factors including infrastructure development, economic growth in developing countries, and increasing internet penetration, the wire and cable market is anticipated to expand in the coming years.

The global wires and cables market size was estimated at USD 183.14 billion in 2020. It is expected to expand at a compound annual growth rate (CAGR) of 4.4 percent by 2028. Rising urbanisation and growing infrastructure worldwide are some of the major factors driving the market. The said factors have impacted the power and energy demand in commercial, industrial, and residential sectors. Increased investments in smart upgrading of the power transmission and distribution systems and the development of smart grids are anticipated to drive the market growth. Implementation of smart grid technology has met the increasing need for grid interconnections, thus resulting in rising investments in the new underground and submarine cables.

The smart grid is an electric grid that includes controls, automation, computers, and innovative equipment and technologies that function together and offer efficient electricity transmission. The functioning of the entire globe depends on the timely delivery of electric supply. Further, the increasing population leads to rising demand for power. Technological advancement in grids is necessary to reduce the frequency and duration of storm impacts, power outages, and restore service quickly after outages.

Increased energy demands in the Asia Pacific, Middle East, and South America have resulted in rising investments in smart grids in these regions. This will fuel the demand for low voltage cables. Urbanisation and industrialisation are the major reasons for increasing the overall market growth. The need for power grid interconnections in areas with a dense population is creating a demand for underground and submarine cables. The underground cables reduce the space required and offer reliable transmission of electricity.

The COVID-19 outbreak has impacted the wires and cables market growth due to a few minor shifts that occurred in communication technologies. The telecommunications industry has highly benefited from the situation as the pandemic has highlighted the true value of connectivity. 5G progress in connections and deployments has continued despite the pandemic and resulting economic downturn.

Voltage Insights

The low voltage segment accounted for the largest revenue share in 2020, with around 43 percent market share, owing to the high usage of low voltage cables in building wires, LAN cables, appliance wires, distribution networks, and others. These wires and cables support the smart grids in delivering superior electric supplies and offer an improved provision of electric supply for end-use consumers. The energy and power sectors across the world are experiencing a rapid alteration. Most of the developing and developed countries are experiencing heavy demand for electricity and are moving towards the incorporation of large-scale renewable resources.

The high voltage wires and cables are used for transmission of electricity from 1,000 volts. These cables are coated with paper and oil, to avoid direct contact of the cables with an individual or any other material. The quality of high voltage cables depends upon the insulation material type used. The high demand for these cables from the end-users such as power distribution, oil and gas, telecom, aerospace, and defense is the major factor responsible for the growth of the high voltage cable market over the forecast period.

Installation Insights

According to the research conducted and published by ‘Grand View Research’, “The overhead installation segment accounted for the largest revenue share in 2020, with around 64 percent market share. This technique is the widely used approach across the world and is the easiest and cheapest form of installation, and is mostly adopted in countries with a lower population.” However, countries with a high risk of natural calamities such as earthquakes and floods tend to have overhead cable installation.

The underground installation segment is expected to expand at the highest CAGR over the forecast period. The underground cable installation lowers the maintenance costs, incurs fewer transmission losses, and hence, effortlessly sustains the power loads. The developing countries such as India, China, Vietnam, amongst others are spending a significant portion of their GDP on infrastructure development.

End-use Insights

The energy and power segment accounted for the largest revenue share in 2020, with around 37 percent market share. Several technological upgrades such as shifting the old transmission lines to high/extra high voltage lines to avoid the transmission losses are been made in the electricity T&D ecosystem. These changes aim at making the ecosystem stable in contradiction of the alternating nature of renewable sources of energy. Moreover, the introduction of new methodologies such as synchronised charging of electric vehicles and net metering for solar homes have aggressively affected the utilities sector. However, the growing renewable power capacity and energy generation have further augmented the need of countries to interrelate their transmission systems.

Owing to factors including infrastructure development, economic growth in developing countries, and increasing internet penetration, the wire and cable market is anticipated to grow over the forecast period.

Regional Insights

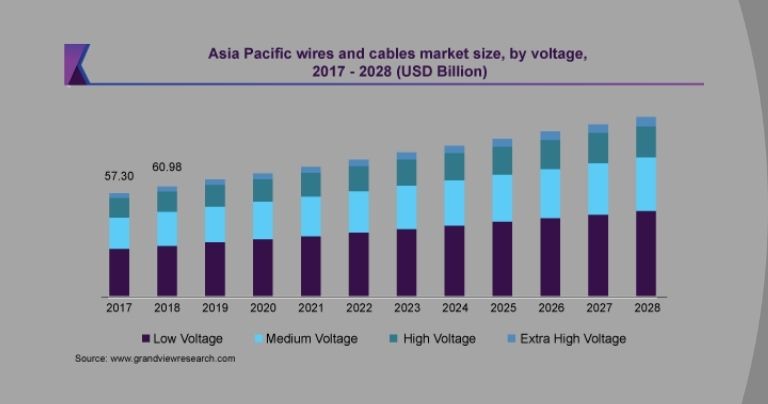

Asia Pacific accounted for the largest revenue share in the wires and cables industry in 2020, with a 37.2 percent market share. The demand for wires and cables is observed to be stable in North America; however, the European region is expected to grow over the forecast period owing to initiatives such as Digital Agendas for Europe 2025.

The market in Asia Pacific region is anticipated to expand at the highest CAGR of 4.7 percent over the forecast period. The growing demand for light, power, and communication is anticipated to fuel the market over the forecast period. The government initiatives such as “Make in India”, and “Go Green” policy is expected to drive the market in India. According to the Indian Electrical Equipment Industry Mission Plan 2012-2022, the government of India has planned to make the country one of the electrical equipment producers and obtain productivity of US$ 100 billion by matching the exports and imports, hence driving the demand for cables over the period 2012-2022.

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.